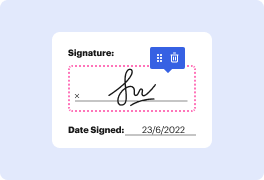

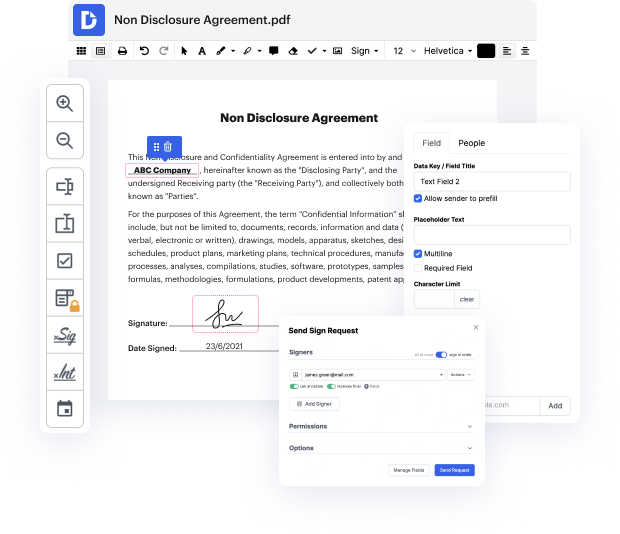

Time is an important resource that each company treasures and tries to convert into a reward. In choosing document management software, be aware of a clutterless and user-friendly interface that empowers consumers. DocHub delivers cutting-edge features to maximize your file management and transforms your PDF file editing into a matter of one click. Insert Phone Field to the Profit Sharing Plan with DocHub in order to save a ton of time and improve your productivity.

Make PDF file editing an easy and intuitive operation that will save you plenty of valuable time. Quickly change your documents and deliver them for signing without the need of turning to third-party options. Focus on pertinent duties and enhance your file management with DocHub starting today.

hey Chandler bolt here and in this video Im gonna talk to you about how to create a company profit share so really how you can get your employees to buy into your business and kind of what youre doing long term so you can be way more profitable and also if youre anything like me youre in business because you care about people and youre in business because you care about making a difference so Im just a firm believer in using profit share as a tool to not only teach people about business but also to help people make a whole lot more money and everyone wins in my opinion when you got a profit share set up at your company but can be kind of like a sticky thing and I know when I was researching how to set up a profit share theres not a lot of great information out there and theres also a ton of ways that you can do it so Im gonna break down kind of a few ways that you can do it and then Ill dive into the specifics on how I do it at my company and this has been really really effec