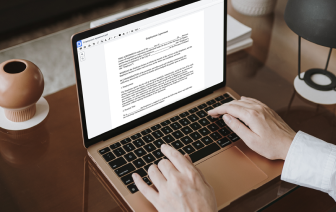

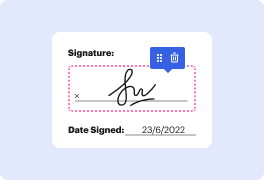

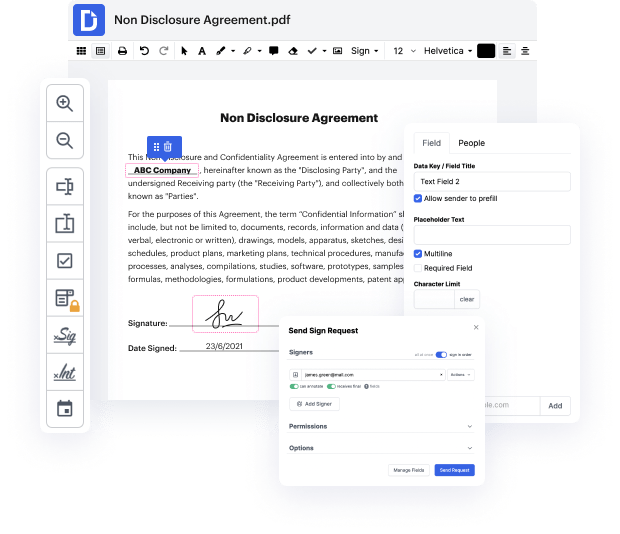

Time is a crucial resource that every business treasures and attempts to change into a gain. When selecting document management software, take note of a clutterless and user-friendly interface that empowers users. DocHub gives cutting-edge instruments to optimize your file administration and transforms your PDF file editing into a matter of a single click. Insert Mark into the Credit Agreement with DocHub to save a ton of efforts and enhance your efficiency.

Make PDF file editing an easy and intuitive operation that will save you plenty of valuable time. Easily alter your documents and deliver them for signing without having looking at third-party solutions. Focus on relevant duties and increase your file administration with DocHub right now.

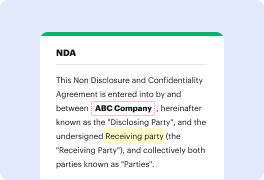

welcomes at the five-minute legal master series were expert attorneys help you master important legal topics today board-certified creditors rights attorney Nicholas D Kralik discusses credit agreements welcome today I want to talk to you a little bit about credit agreements you know in the euphoria of getting a new customer not many creditors especially their sales departments want to think about their customer becoming a debtor somewhere down the line however when a creditor extends credit to that new customer hes essentially lending his companys money and there is a risk that the creditor may not get paid by this customer therefore the outset of the business relationship with a new customer that is precisely the time to be proactive to anticipate what rights and remedies you as the credit grantor will want and need to have at your disposal if and when the new customer becomes a non-compliant debtor youve got to prepare for collection from day one and nobody likes to think about