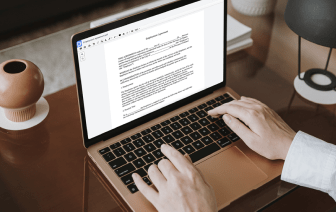

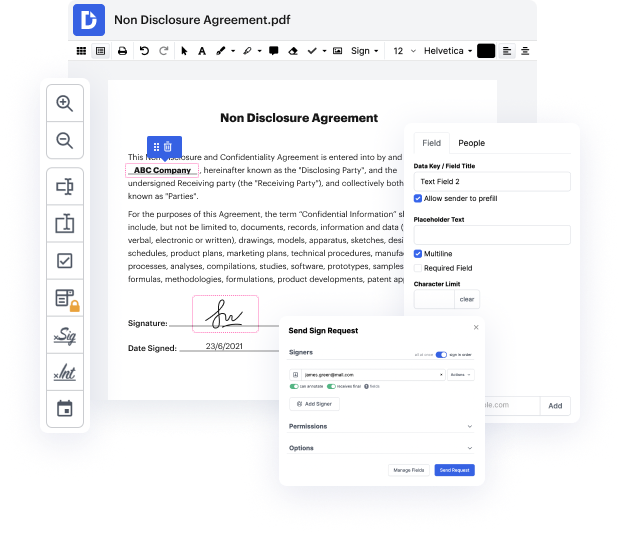

tex may not always be the easiest with which to work. Even though many editing tools are available on the market, not all offer a easy solution. We developed DocHub to make editing effortless, no matter the document format. With DocHub, you can quickly and easily insert FATCA in tex. In addition to that, DocHub gives a range of other features including document creation, automation and management, sector-compliant eSignature services, and integrations.

DocHub also helps you save time by creating document templates from paperwork that you utilize frequently. In addition to that, you can benefit from our a wide range of integrations that allow you to connect our editor to your most used apps with ease. Such a solution makes it quick and easy to deal with your documents without any slowdowns.

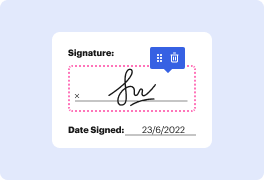

DocHub is a useful tool for personal and corporate use. Not only does it offer a comprehensive suite of features for document creation and editing, and eSignature implementation, but it also has a range of tools that prove useful for developing complex and streamlined workflows. Anything imported to our editor is stored risk-free in accordance with major field standards that shield users' information.

Make DocHub your go-to choice and streamline your document-centered workflows with ease!

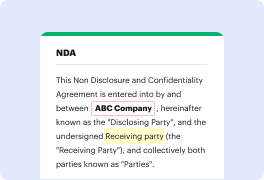

good afternoon this is sean golding with goldie and golding here to discuss the basics of what is fatca what is the foreign account tax compliance act why do you care and how do you comply right like a fatca foreign account tax compliance act uh for u.s person this presentation is focused toward uh individuals uh u.s entities trusted in states that have to report not foreign financial institutions that have their own requirement from a tax perspective fact it came into effect in 2011 on the tax return whereas us persons have to include form 8938 if they meet the threshold requirements for reporting itamp;#39;s used to report specified foreign financial assets itamp;#39;s different than the f bar the f bar is another acronym thrown around on all foreign bank and financial account reporting the fbar is covered under title 31 which is money in finance not 26 which is the internal revenue code an important aspect of that is that when youamp;#39;re filing the uh the f bar youamp;#39;re