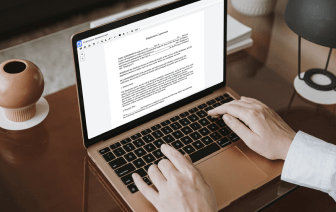

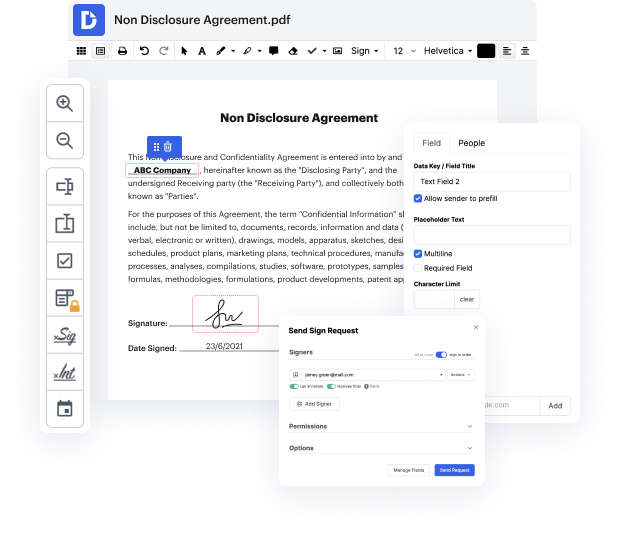

Time is a vital resource that each business treasures and tries to change into a reward. When picking document management software, focus on a clutterless and user-friendly interface that empowers consumers. DocHub gives cutting-edge features to optimize your document managing and transforms your PDF file editing into a matter of a single click. Insert EU Currency Field into the 12 Month Income Statement with DocHub to save a ton of efforts and boost your productiveness.

Make PDF file editing an simple and easy intuitive process that saves you plenty of valuable time. Quickly modify your documents and send them for signing without looking at third-party software. Focus on pertinent tasks and increase your document managing with DocHub today.

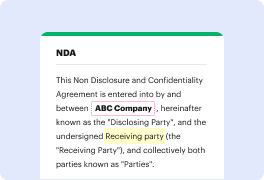

Sage 50 provides a standard 12-period income statement, but users may also want a 12-period balance sheet. The video tutorial demonstrates creating a balance sheet using the flexible Sage 50 Financial Statement Designer. To start, navigate to the reports and forms menu, select financial statements, and copy the 12-period income statement as a foundation. After clicking the design button, you can easily copy column descriptions by right-clicking and selecting copy. If prompted to save changes, choose 'no.' Next, select the desired balance sheet format to proceed with creating the new report efficiently.