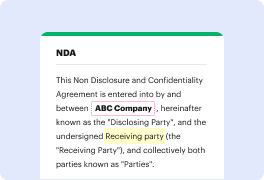

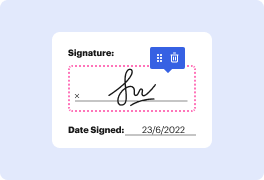

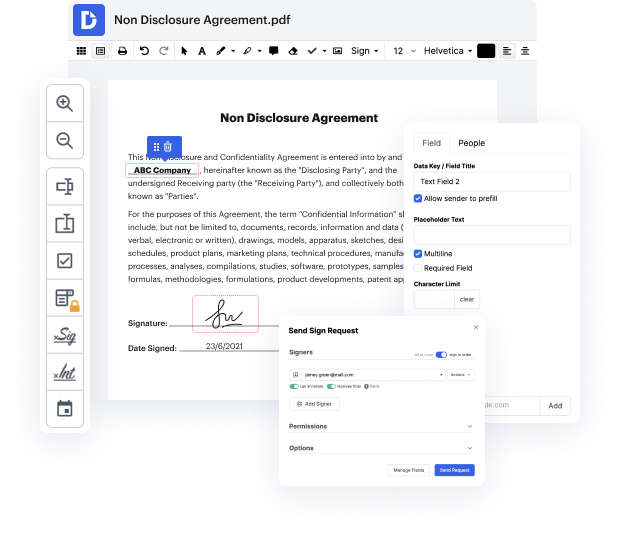

Time is a vital resource that each company treasures and tries to convert in a reward. When picking document management application, focus on a clutterless and user-friendly interface that empowers users. DocHub delivers cutting-edge tools to improve your file managing and transforms your PDF file editing into a matter of a single click. Insert Demanded Field from the Retirement Plan with DocHub to save a lot of time and enhance your efficiency.

Make PDF file editing an simple and easy intuitive process that saves you a lot of valuable time. Quickly modify your files and send them for signing without switching to third-party solutions. Focus on relevant duties and improve your file managing with DocHub today.

if theres a chance that you may receive an inheritance in the future and knowing these four things is going to be important and if its a ways off or if it may never happen just store these in the back of your brain but we can get right into it number one is just expect the process to take some time because settling in a state is a big task when a person passes away theres things that if theyre not in order it can really mean things are a lot more difficult and Gallup actually says that less than half of the adults in the U.S have a will right now but even when things are in a proper estate plan things can still take time and if assets are held in a trust the probate process doesnt have to happen which is nice so thats thats important however even distributions from trusts can take some time uh really they can be hard to understand sometimes depending on the type of trust so because of this and some of the other factors that that come into play and along the way of a estate settl