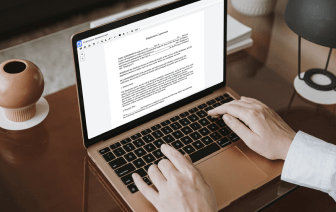

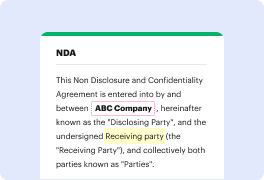

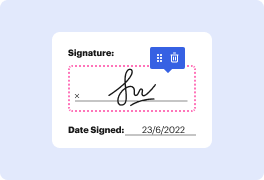

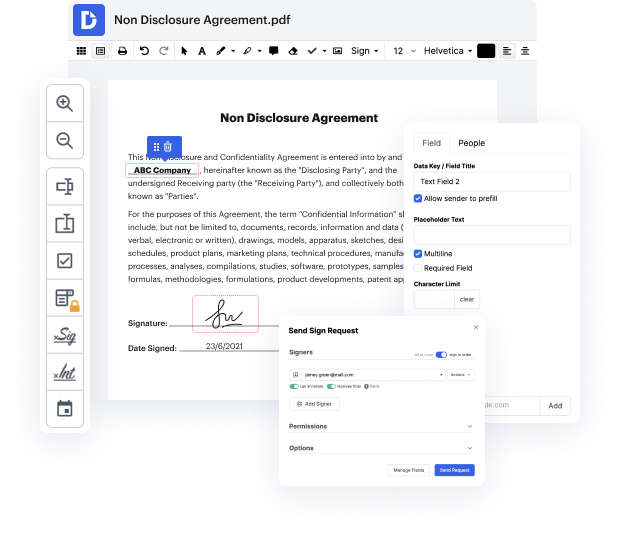

Time is an important resource that every organization treasures and attempts to turn in a benefit. When selecting document management software program, focus on a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge instruments to enhance your document administration and transforms your PDF file editing into a matter of a single click. Insert Calculations into the Retirement Plan with DocHub to save a ton of time and enhance your productivity.

Make PDF file editing an simple and easy intuitive operation that will save you a lot of precious time. Quickly adjust your documents and deliver them for signing without the need of adopting third-party software. Focus on pertinent tasks and improve your document administration with DocHub starting today.

hey whats up everyone bill Lessman here for money evolution calm in todays video Im going to be talking about how to calculate your retirement savings goal so probably one of the most frequently asked questions that we get asked here all the time is how much money do I need to have saved up for me to be able to retire and live the lifestyle that I want to live well theres a couple of different methods for doing this and one of the things weve talked about pretty extensively here on the blog and on our video channel over on YouTube is going through our expense worksheets in fact actually if you havent already checked those out well have a link below todays video so you can access those and thats where youre gonna basically go through everything from your housing expenses trying to estimate your utilities your car expenses your travel and really kind of going through the nitty-gritty of that what Im gonna do here in todays video is were gonna kind of take a completely differ