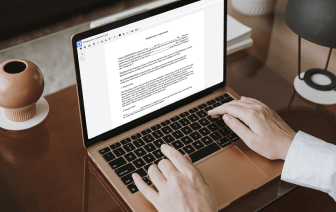

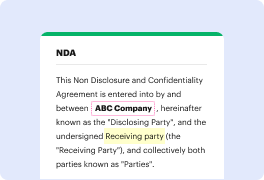

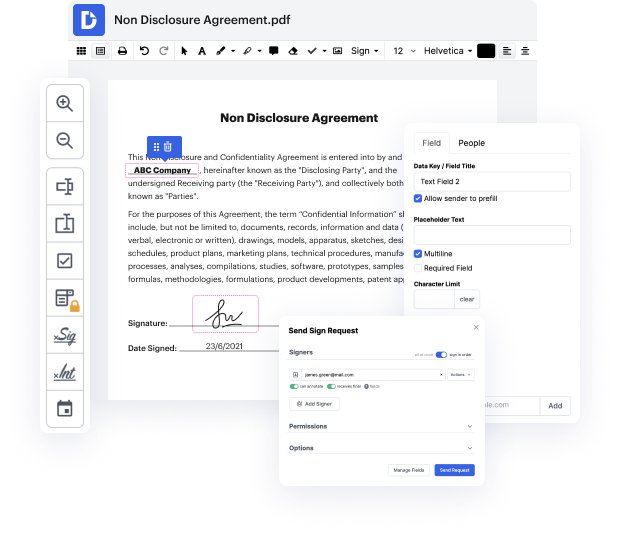

Time is a crucial resource that every organization treasures and tries to convert into a benefit. In choosing document management application, focus on a clutterless and user-friendly interface that empowers customers. DocHub delivers cutting-edge tools to optimize your document managing and transforms your PDF editing into a matter of one click. Insert Calculated Field into the Assignment Of Partnership Interest with DocHub in order to save a lot of time as well as enhance your efficiency.

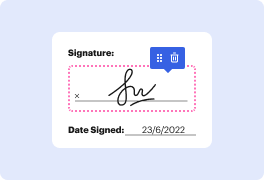

Make PDF editing an simple and easy intuitive operation that helps save you plenty of precious time. Quickly change your documents and send out them for signing without having switching to third-party solutions. Focus on relevant tasks and improve your document managing with DocHub starting today.

hello in this lecture were going to talk about partnerships and were going to talk about the selling of a partnership interest we will be able to describe the process of selling a partnership interest create the journal entry to record the sale of a partnership interest define the effect of journal entry to sell a partnership interest on the trial balance accounts and explain the effect on the capital accounts of selling a partnership interest so were going to do this by looking at a problem were going to look through the problem post the transaction see what happens to the capital counts in terms of both a trial balance as well as a format of just a worksheet type of format this is going to be our simplified accounts that we will be looking at only cash that were going to have only asset that we will have will be cash only liability accounts payable and then we will have our capital accounts this is where we will be focusing on and then we have the income statement down here note