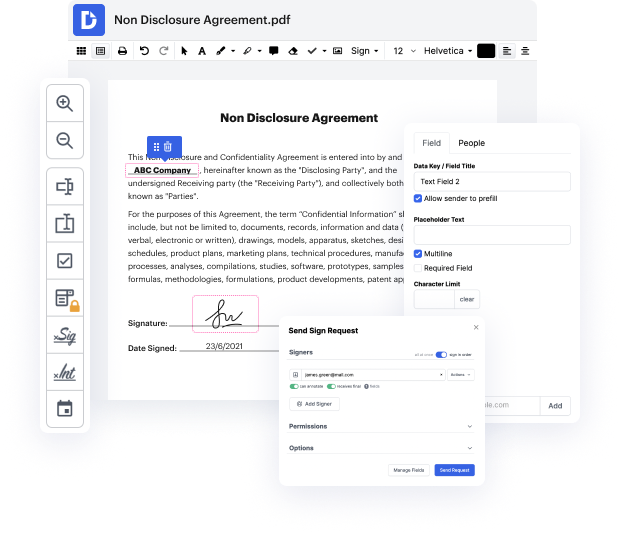

Time is a vital resource that each organization treasures and attempts to turn in a reward. When choosing document management application, focus on a clutterless and user-friendly interface that empowers users. DocHub offers cutting-edge tools to improve your file managing and transforms your PDF file editing into a matter of a single click. Insert Calculated Field from the Church Donation Giving Form with DocHub to save a ton of time and improve your productiveness.

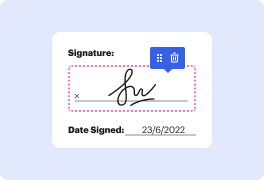

Make PDF file editing an simple and intuitive operation that saves you a lot of valuable time. Effortlessly modify your files and send them for signing without having switching to third-party options. Give attention to pertinent tasks and increase your file managing with DocHub right now.

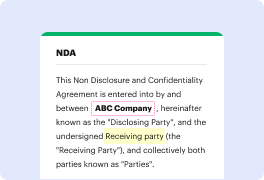

just about everyone knows that charitable contributions are tax-deductible millions of americans give to charity by giving cash and non-cash items as well as volunteering their time in this video were going to take a deeper dive into what constitutes a charitable deduction and how theyre properly reported on your tax return im the tax geek back with more of your taxes oversimplified [Music] first of all lets look at the types of organizations you can make deductible contributions to not-for-profit organizations are recognized by the irs under section 501c of the internal revenue code which allows these organizations to accept donations and not treat them as taxable income im sure that youve heard of 501c3 organizations which are the most common type of nonprofit organizations these can include churches service organizations such as the red cross and march of dimes not-for-profit schools colleges and universities public television and radio stations public and private foundations