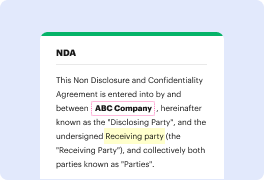

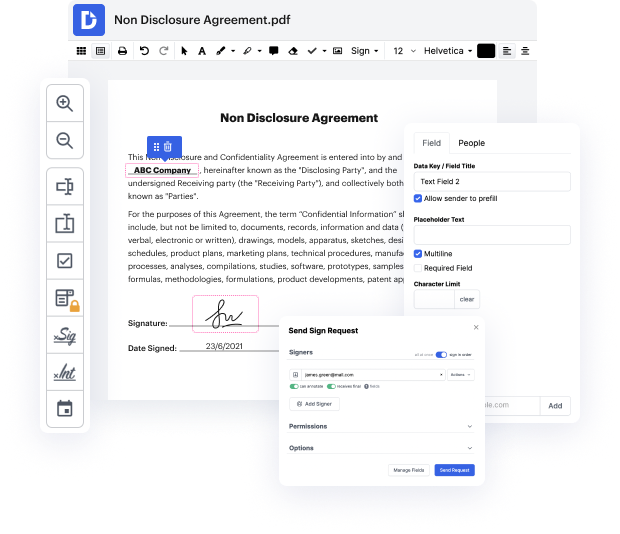

LOG may not always be the easiest with which to work. Even though many editing features are out there, not all give a straightforward tool. We created DocHub to make editing effortless, no matter the form format. With DocHub, you can quickly and easily inject FATCA in LOG. On top of that, DocHub gives a variety of other features such as document generation, automation and management, field-compliant eSignature services, and integrations.

DocHub also lets you save time by creating document templates from paperwork that you use regularly. On top of that, you can take advantage of our a wide range of integrations that allow you to connect our editor to your most utilized programs easily. Such a tool makes it fast and simple to deal with your documents without any slowdowns.

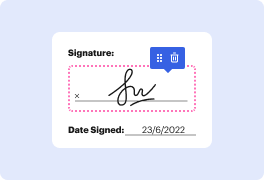

DocHub is a helpful feature for individual and corporate use. Not only does it give a extensive suite of tools for document generation and editing, and eSignature integration, but it also has a variety of features that prove useful for developing complex and streamlined workflows. Anything uploaded to our editor is saved safe according to major industry standards that protect users' data.

Make DocHub your go-to option and simplify your document-driven workflows easily!

Welcome to our quick take on the foreign account tax compliance act or fatka the law thatamp;#39;s changed the game for international tax evasion passed in 2010 fatco requires foreign Banks to report on Americans overseas accounts hereamp;#39;s a deal fatco requires foreign Banks to identify us taxpayers with foreign Financial accounts Banks worldwide then must report those accounts to the IRS the IRS can then use that information to identify Americans hiding assets and income overseas itamp;#39;s all about transparency hiding money offshore is getting tougher whatamp;#39;s the result a Crackdown on tax Havens and billions unveiled in Hidden assets fatka has made life hard for international tax Havens and us taxpayers with assets overseas but thatamp;#39;s just part of the story stay tuned for the next piece of this financial puzzle