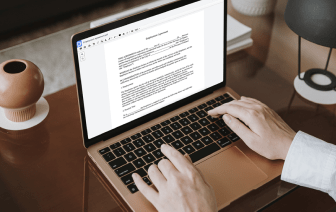

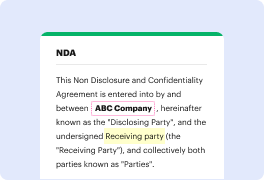

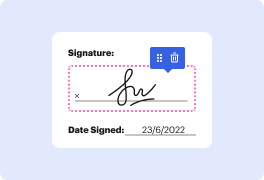

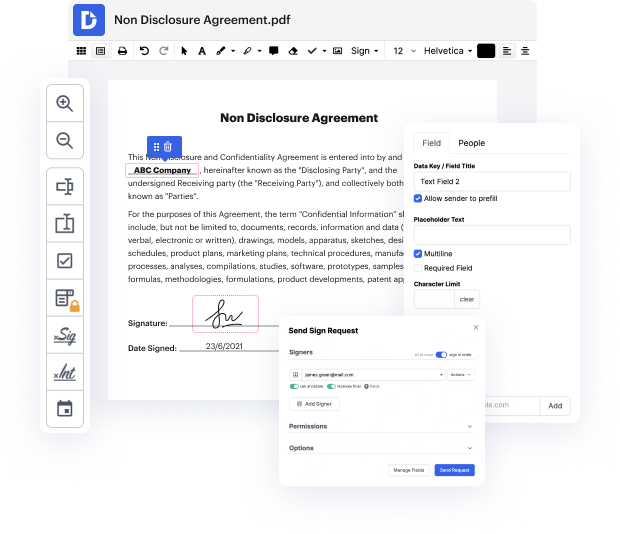

You no longer have to worry about how to inject FATCA in ASC. Our powerful solution provides easy and fast document management, allowing you to work on ASC documents in a couple of minutes instead of hours or days. Our platform contains all the tools you need: merging, inserting fillable fields, approving forms legally, adding symbols, and so on. There’s no need to set up extra software or bother with high-priced programs requiring a powerful computer. With only two clicks in your browser, you can access everything you need.

Start now and manage all different types of forms professionally!

hi this is Anthony parents of IRS medic now the foreign account tax compliance act has something called igas and This Acronym might be messing you up or just sort of making you angry like it kind of does me like every acronym they come up with uh you hear it thrown around and sometimes you forget what does it mean and what is it exactly it stands for inter-government agreement um but itamp;#39;s actually something I donamp;#39;t think weamp;#39;ve ever quite seen and John uh with me is John Richardson and Keith Redmond and this is my question for John and Iamp;#39;m gonna Iamp;#39;m gonna do a screen share of um your your tweet that got me thinking about this um hereamp;#39;s my question for you um you are a student of history and you know far more things than I do can you think of a time in our history in the worldamp;#39;s history weamp;#39;re something like a fatca intergovernment agreement existed well thatamp;#39;s you know thatamp;#39;s a really tough question um the th