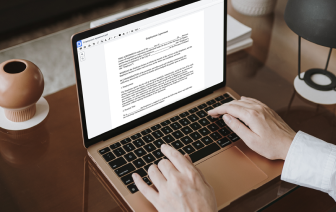

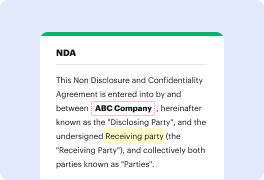

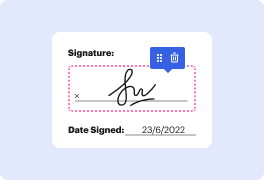

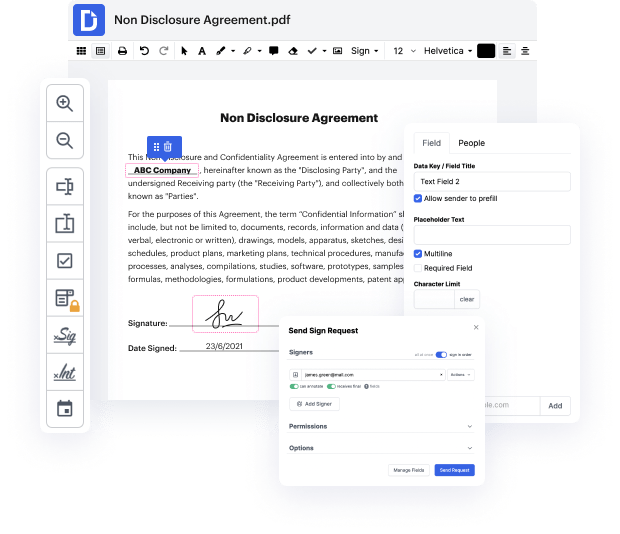

Time is a vital resource that every enterprise treasures and attempts to turn in a reward. When selecting document management software, focus on a clutterless and user-friendly interface that empowers users. DocHub provides cutting-edge features to improve your document administration and transforms your PDF file editing into a matter of one click. Hide SNN Field in the Employment And Salary History List with DocHub to save a ton of time and increase your productivity.

Make PDF file editing an simple and easy intuitive operation that saves you a lot of valuable time. Easily adjust your documents and send them for signing without having turning to third-party options. Give attention to relevant duties and increase your document administration with DocHub right now.

four million 669 359 people are subject to Irma penalties oh theyre not Pelt yes they are theyre tax increases free Medicare I I was stunned by that amount stunned there are only 60 well just Round Up 64 only theres 64 million Americans who are in part A Part B or part or both and Part B part A and part D so over seven percent of all Medicare beneficiaries are subject to Irma premium increases I I was stunned by this dude its only going to get worse and Ill show you why Ill prove it to you this is us so what is Irma Irma is the income and Ill just dive into it here this is from uh I cant remember if its from the Social Security um I just do my daily readings oh Im interested in this so this Irma income related monthly adjustment amount Irma this is 2021 its not even 2022 and 2023 so what happens under Irma is if your income is above a certain threshold is because the uh the Medicare modernization Act of 2003. yeah they really modernize it clowns uh if you if you have a an i