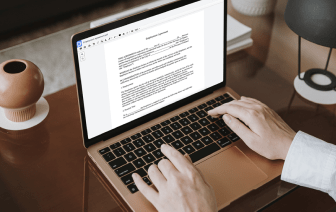

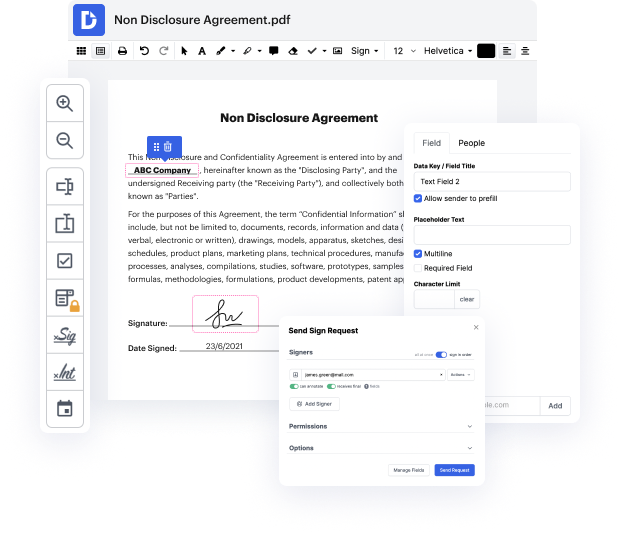

Time is an important resource that each organization treasures and tries to transform in a benefit. When choosing document management software, focus on a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge features to enhance your document managing and transforms your PDF file editing into a matter of a single click. Hide Field Validation from the Share Repurchase Agreement with DocHub in order to save a lot of time and boost your efficiency.

Make PDF file editing an simple and intuitive process that saves you a lot of precious time. Easily modify your files and deliver them for signing without looking at third-party options. Focus on pertinent tasks and boost your document managing with DocHub starting today.

in this video we will discuss dividends and share repurchase agreements my name is Kirby our Cundiff I have a PhD from the University of Illinois at urbana-champaign Im a chartered financial analyst and a certified financial planner Im currently chair of accounting and financial management for the Graduate School of the University of Maryland University College there are three primary theories about how a company should choose its dividend to maximize its stock price these three are called the dividend irrelevance theory which is what it sounds like it doesnt matter how they set the dividend the bird in the hand theory where investors are believed to trust companies that pay higher dividends since they actually see cash and the tax preference Theory where investors dont want dividends because theyre taxed at a higher rate than other forms of incomes such as capital gains if we look at the stock price as a function of payout for each of these theories again for the dividend irrelev