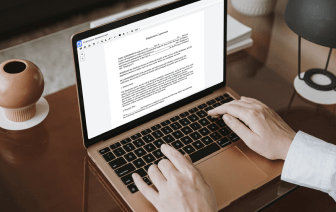

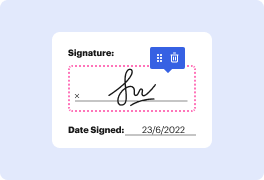

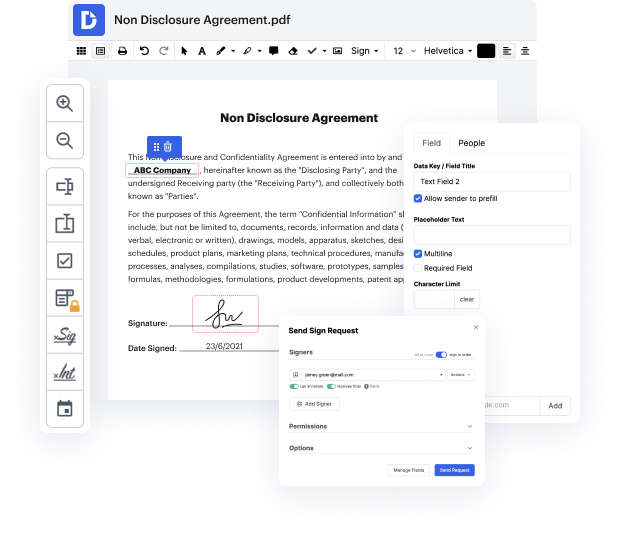

Time is a vital resource that each business treasures and attempts to turn into a reward. When picking document management application, be aware of a clutterless and user-friendly interface that empowers users. DocHub provides cutting-edge features to maximize your document managing and transforms your PDF editing into a matter of a single click. Hide Electronic Signature to the Notice Of Credit Limit Increase with DocHub to save a lot of time and enhance your productiveness.

Make PDF editing an simple and intuitive operation that will save you a lot of precious time. Quickly change your files and send them for signing without looking at third-party software. Focus on relevant tasks and improve your document managing with DocHub today.

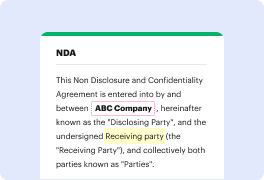

chase bank out of all the banks is pretty stingy on giving you a credit limit increase in my experience but there are so many reasons why you would want a credit limit increase whether that is to decrease your utilization rate to increase your credit score youre going to make a large purchase soon and you want to put it all on your chase free and unlimited to earn the extra half point or you just want the extra benefits of a visa signature card over the plane visa which is the main reason i wanted a credit limit increase its a good way to get extra insurances like extended warranty travel and emergency assistant and a concierge service on a card you already have and use so here are three ways to get a credit limit increase with chase so the most basic way is just to ask for a credit limit increase at the moment there isnt a way to request a credit limit increase online you can only make a request by calling the number on the back of your card before you