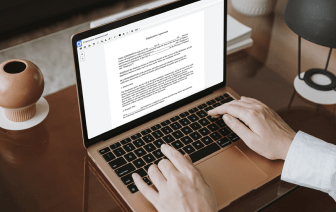

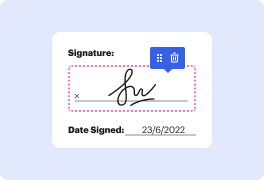

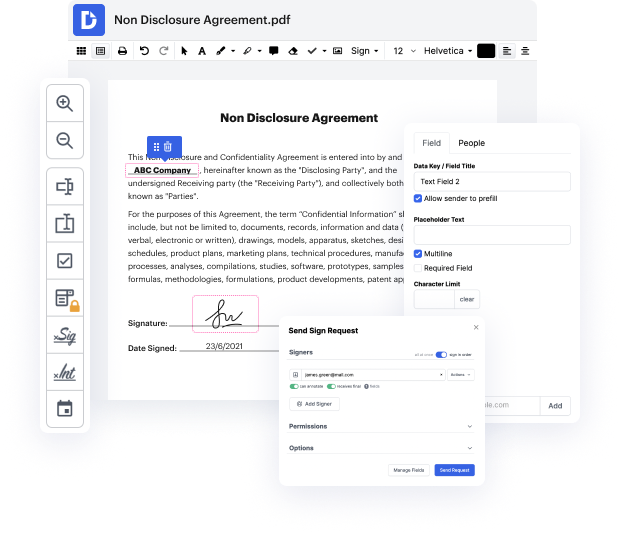

Time is a crucial resource that every enterprise treasures and tries to convert in a benefit. When choosing document management software, pay attention to a clutterless and user-friendly interface that empowers consumers. DocHub delivers cutting-edge tools to maximize your document administration and transforms your PDF editing into a matter of a single click. Hide Dropdown to the Notice Of Credit Limit Increase with DocHub to save a ton of efforts and increase your efficiency.

Make PDF editing an easy and intuitive operation that will save you plenty of valuable time. Effortlessly change your files and deliver them for signing without the need of adopting third-party alternatives. Concentrate on relevant tasks and improve your document administration with DocHub starting today.

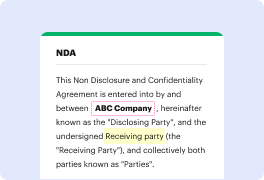

[Music] hey are you looking to build your business credit like a boss well youre in luck ive created this awesome ebook where you can learn how to build business credit and get over 500 000 in business funding its on sale right now 40 on sale original price is 125. i am giving you guys this at a highly discounted price but only a hundred copies will be sold at this price click the link in description below or in a pin comment you are already a boss why not get that business credit like a ball hi everyone its your girl designer so boss and i am back with another video so in todays video were going to talk about if you requested a navy federal credit limit increase on your current credit card and you got no response what you should do and what may have happened so if youre interested stay tuned so what happened have you tried to request the credit limit increase with the lock to score method so you wont get any harmful if you have done so now youre waiting on their response and