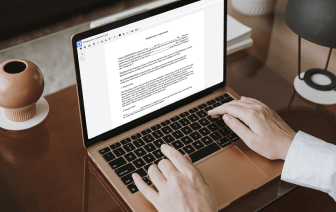

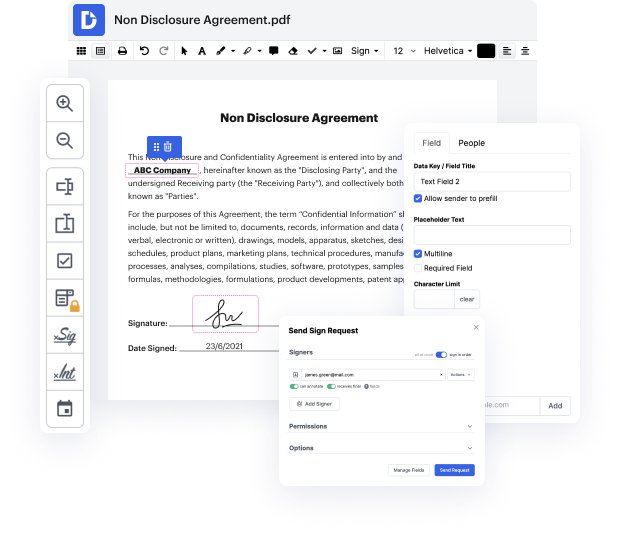

Time is an important resource that each organization treasures and attempts to change into a advantage. When selecting document management application, be aware of a clutterless and user-friendly interface that empowers consumers. DocHub offers cutting-edge tools to maximize your file administration and transforms your PDF editing into a matter of one click. Hide Dropdown Menu Fields to the Payroll Deduction Authorization with DocHub in order to save a ton of time as well as boost your productiveness.

Make PDF editing an simple and intuitive process that saves you plenty of precious time. Easily change your files and send out them for signing without the need of adopting third-party software. Concentrate on pertinent duties and improve your file administration with DocHub right now.

welcome to our tutorial on how to set up payroll deductions in your sage business works program this short presentation will show you how to set up payroll deductions how to assign the deductions to your employees and how to enter the deduction amounts in your time card entries deductions are used for recording fringe benefits such as medical insurance retirement or pension plan contributions union dues workers compensation or local taxes regular taxes such as federal and state withholding do not need to be set up if you have a deduction that is part employee and part employer contribution you must set up as two separate deductions and assign both deduction ids to the employee and maintain employees a maximum combination of 30 deductions and or other pays can be assigned to an employee important be sure to consult the internal revenue service or your tax advisor when you set up deductions many times there are special requirements for how they appear on the w-2 form and these rules chan