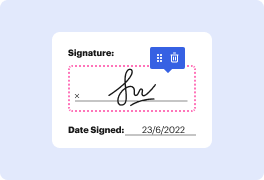

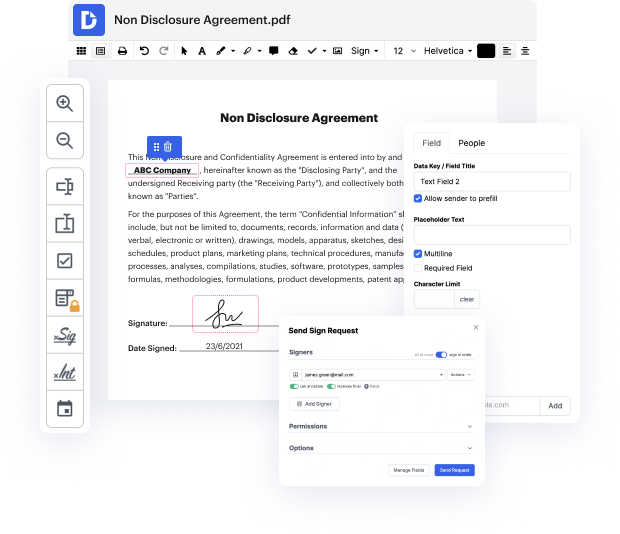

Time is a crucial resource that each organization treasures and tries to convert in a gain. When picking document management application, focus on a clutterless and user-friendly interface that empowers customers. DocHub delivers cutting-edge tools to enhance your file management and transforms your PDF editing into a matter of one click. Hide Calculated Field in the Mortgage Financing Agreement with DocHub to save a ton of time as well as increase your productivity.

Make PDF editing an easy and intuitive process that will save you a lot of precious time. Effortlessly change your documents and send them for signing without the need of adopting third-party alternatives. Concentrate on pertinent duties and increase your file management with DocHub starting today.

the last thing you want is for a loan officer to tell you that buying a home is going to cost this much and then they say wow things have changed and its actually going to cost this much and then a few days later well things have changed again and now its this much and youre sitting there thinking where in the world did all these increases come from and do we even have the money to be able to pay for this in this trick that loan officers do is so compelling that ive lost clients because of it so here it is loan officers know that most people like you are shopping their loans to find the best rates and the best costs so to win your business so many loan officers will only quote certain costs that theyre required to tell you when they show you how much it will be uh or how much it will cost to buy a home and ill cover more on what these two tricks are but a perfect example of this is i was talking to one of you someone who was watching one of my youtube videos um and they docHubed o