Document editing comes as an element of many professions and jobs, which is why tools for it should be reachable and unambiguous in terms of their use. A sophisticated online editor can spare you plenty of headaches and save a considerable amount of time if you need to Group payment attestation.

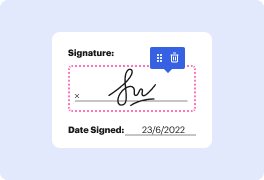

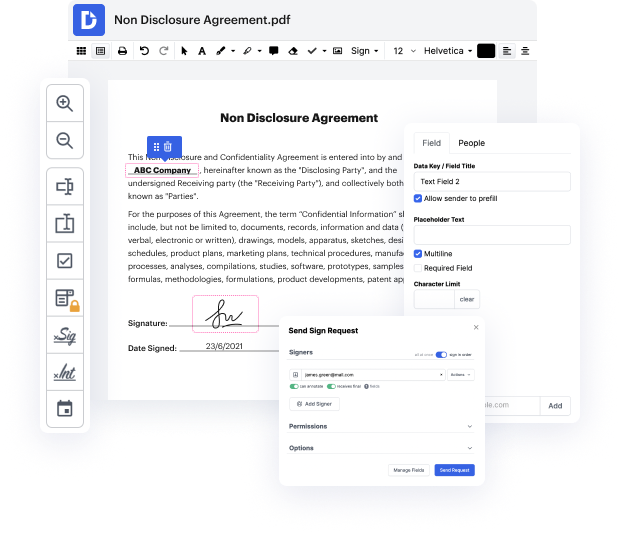

DocHub is a great example of an instrument you can grasp very quickly with all the important functions accessible. Start editing immediately after creating an account. The user-friendly interface of the editor will help you to find and utilize any feature in no time. Feel the difference with the DocHub editor as soon as you open it to Group payment attestation.

Being an integral part of workflows, document editing must stay simple. Utilizing DocHub, you can quickly find your way around the editor and make the desired modifications to your document without a minute wasted.

hello and welcome to the session this is Professor for hat in this session we would look at meta Station engagement and specifically were going to distinguish the AICPA at the stations standard from the auditing standard now all the thing is a form of attestation but basically we have to distinguish or the thing from other attestation this is what were trying were gonna try to do so this is basically part of the assurance service module we looked at reviews we looked at compilation we looked at reviews of public review of publicly public companies quarterly report and now were going to be looking at attestation again were going to go back and look at assurance to find assurance first and see how assurance and devastation fits together what is it assurance and assurance is a service when a professional such as a CPA is engaged to give an opinion about the financial statements so decision-makers can have can make better decisions so basically youre improving the quality of the in

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more