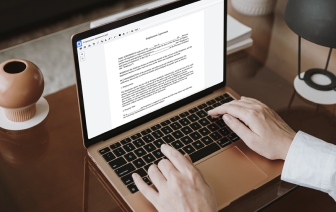

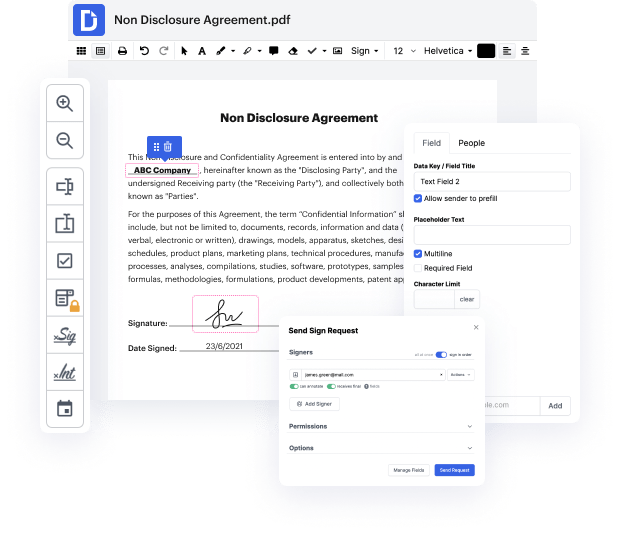

Working with papers like Donation Receipt might appear challenging, especially if you are working with this type for the first time. At times even a little modification might create a big headache when you don’t know how to work with the formatting and avoid making a mess out of the process. When tasked to fix sign in Donation Receipt, you can always use an image modifying software. Other people might choose a classical text editor but get stuck when asked to re-format. With DocHub, though, handling a Donation Receipt is not more difficult than modifying a document in any other format.

Try DocHub for fast and productive document editing, regardless of the document format you might have on your hands or the kind of document you have to revise. This software solution is online, accessible from any browser with a stable internet connection. Modify your Donation Receipt right when you open it. We’ve developed the interface so that even users with no previous experience can easily do everything they need. Streamline your forms editing with a single streamlined solution for just about any document type.

Dealing with different types of papers should not feel like rocket science. To optimize your document editing time, you need a swift platform like DocHub. Manage more with all our instruments on hand.

our goal is your satisfaction let us show you the way [Music] how much can you claim on donations without receipts 2021 for your donations if you have made donations of two dollars or more to charities during the year you can claim a tax deduction on your return you don't even need to have kept receipts if you donated into a box or bucket and your donation was less than 10 what is the max write-off allowed for charitable donations 60 the amount you can deduct for charitable contributions generally is limited to no more than 60 percent of your adjusted gross income your deduction may be further limited to 50 30 or 20 of your adjusted gross income depending on the type of property you given the type of organization you give it to [Music] how much can you claim in charitable donations without getting audited deductions for your donations to charitable organizations can't exceed 50 of a certain calculation of your adjusted gross income agi and the limit as 30 for donations to certain priv...