Dealing with paperwork implies making minor modifications to them everyday. Occasionally, the task runs almost automatically, especially when it is part of your day-to-day routine. However, in other cases, working with an uncommon document like a Delivery Driver Contract can take valuable working time just to carry out the research. To ensure every operation with your paperwork is trouble-free and fast, you should find an optimal editing tool for such jobs.

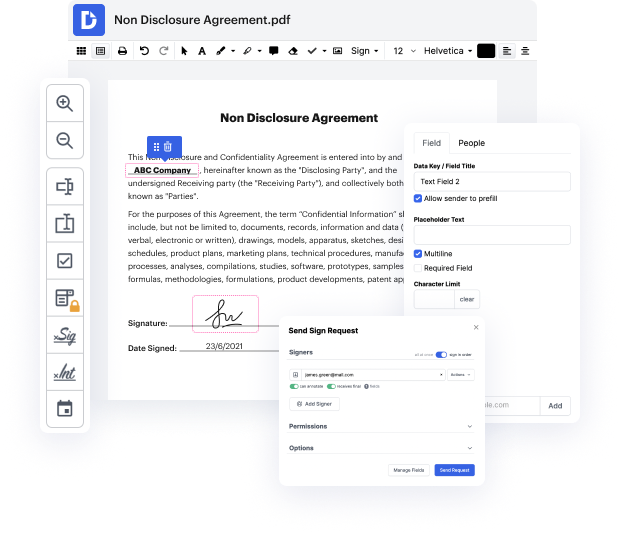

With DocHub, you can learn how it works without spending time to figure it all out. Your tools are organized before your eyes and are easy to access. This online tool does not need any specific background - education or experience - from its end users. It is all set for work even when you are unfamiliar with software typically utilized to produce Delivery Driver Contract. Easily make, edit, and share documents, whether you work with them daily or are opening a new document type the very first time. It takes minutes to find a way to work with Delivery Driver Contract.

With DocHub, there is no need to study different document kinds to figure out how to edit them. Have all the go-to tools for modifying paperwork at your fingertips to streamline your document management.

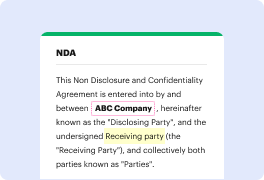

an independent delivery driver contract is made between a company and a driver that is needed to deliver goods or services to customers lets go over common examples of independent delivery drivers and how to create a contract what is an independent delivery driver independent delivery drivers help companies deliver products food or even services to residences and businesses their contract base which means theyre working as independent contractors for the company that they deliver for delivery drivers most commonly perform short to medium distance deliveries for food companies businesses like Amazon and newspaper organizations but with an uprising in popularity and demand for delivered goods drivers find themselves delivering for an ever-widening range of industries since independent delivery drivers are not employees theyll have to fill out a w-9 and will receive a 109 nine from the company which will be used to file taxes the process will be repeated with every company that the dr