Document creation is a fundamental aspect of successful organization communication and administration. You need an cost-effective and practical platform regardless of your papers planning stage. Bridge Loan Agreement planning may be one of those processes which require extra care and attention. Simply explained, there are greater possibilities than manually producing documents for your small or medium enterprise. One of the best approaches to guarantee top quality and usefulness of your contracts and agreements is to set up a multifunctional platform like DocHub.

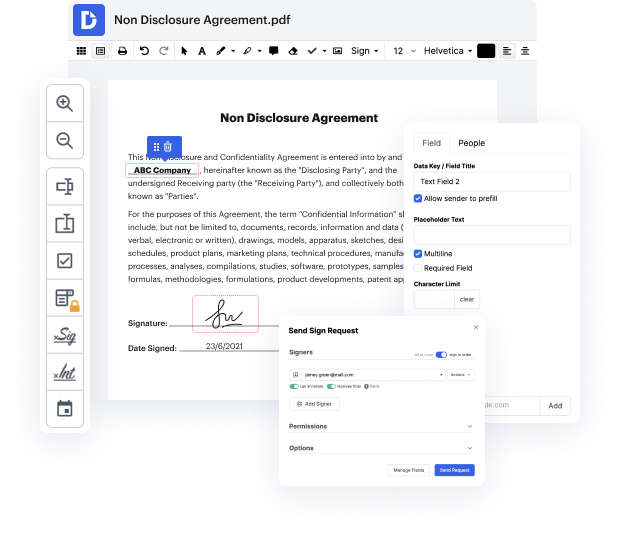

Modifying flexibility is regarded as the significant advantage of DocHub. Use robust multi-use instruments to add and take away, or change any component of Bridge Loan Agreement. Leave comments, highlight important info, finish flag in Bridge Loan Agreement, and change document managing into an easy and user-friendly process. Access your documents at any time and implement new modifications whenever you need to, which may substantially reduce your time developing the same document from scratch.

Produce reusable Templates to streamline your daily routines and avoid copy-pasting the same information continuously. Change, add, and alter them at any moment to make sure you are on the same page with your partners and customers. DocHub can help you prevent mistakes in often-used documents and provides you with the highest quality forms. Ensure you keep things professional and stay on brand with the most used documents.

Benefit from loss-free Bridge Loan Agreement modifying and safe document sharing and storage with DocHub. Don’t lose any files or end up puzzled or wrong-footed when discussing agreements and contracts. DocHub empowers professionals everywhere to implement digital transformation as a part of their company’s change administration.

hey everyone i am Jenova from BTSfunding Im here today to talk to you about bridge loans and their loan terms and so i just want to get into it dont want to take up too much of your time lets just talk about it what are bridge loans bridge loans are short-term financing theyre short-term financing compared to a conventional mortgage which is typically long-term financing bridge loans usually span from 6 to 12 months and they also do typically have a higher interest rate anywhere from 6 to 12 percent and these loans are typically interest only loans of the loan maturity so if you did a nine month loan term and you have eight percent of an interest rate youre gonna only be paying the interest rate for that nine months and then once the nine months is up hopefully at that time youve flipped your property and youve made your profit and youre ready to move on right thats the benefit of having a bridge loan is that you can get a bridge loan flip a prop