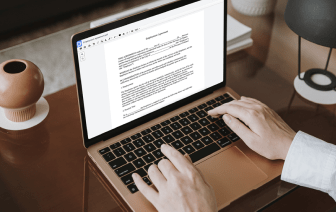

Need to swiftly finish design in Split Dollar Agreement? Your search is over - DocHub has the solution! You can get the task done fast without downloading and installing any application. Whether you use it on your mobile phone or desktop browser, DocHub allows you to edit Split Dollar Agreement at any time, anywhere. Our feature-rich solution comes with basic and advanced editing, annotating, and security features, ideal for individuals and small companies. We also provide lots of tutorials and instructions to make your first experience productive. Here's an example of one!

You don't need to worry about data safety when it comes to Split Dollar Agreement editing. We offer such security options to keep your sensitive information safe and secure as folder encryption, two-factor authentication, and Audit Trail, the latter of which monitors all your actions in your document.

lets explore how split dollar with permanent life insurance can help you use business dollars for personal benefits were going to draw two balance sheets one for the business and one for you lets say that the business is in a 21 tax and you are in a 37 bracket of course actual details will vary but the key is whether the business is in a lower tax bracket than you you have a need for a personally owned permanent life insurance policy and that policy will provide death benefits cash value accumulation and living benefits the goal is to have the business pay the premiums on the policy in a tax-advantaged manner with the key being the use of the businesss 21 tax bracket this is done by having the business pay for the premium but treat that payment as a loan to the policy owner in exchange youll pay relatively low interest back to the business while the loan is outstanding and eventually pay the loan back using policy values through loans or withdrawals if available at a predetermined