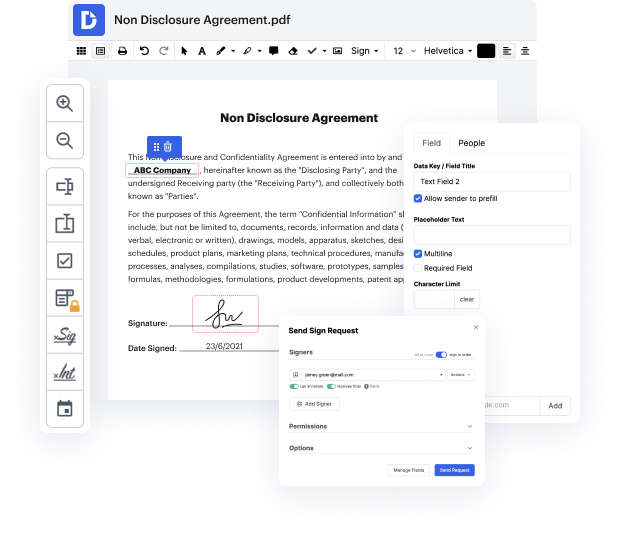

Having full control over your files at any time is important to alleviate your everyday tasks and improve your productivity. Achieve any goal with DocHub features for document management and convenient PDF file editing. Gain access, change and save and incorporate your workflows with other safe cloud storage.

DocHub offers you lossless editing, the possibility to work with any format, and safely eSign papers without having looking for a third-party eSignature alternative. Obtain the most of your file managing solutions in one place. Check out all DocHub functions right now with your free of charge profile.

In this tutorial, we demonstrate how to create a personal loan agreement using DocHub PDF. First, choose your preferred format (DocHub, PDF, Microsoft Word, or rich text). We will use DocHub for its ease of use. The form is fillable; simply click on the blanks to enter information. For example, enter the agreement date as May 24. Identify the borrower (e.g., Johnny Appleseed of 123 Apple Way, Appleville, TX) and the lender (e.g., Nancy Appleseed at the same address). Specify the repayment period—here, we choose one year—and the loan amount, which is set at $10,000. Finally, fill in additional loan details as required.