Not all formats, including dot, are designed to be effortlessly edited. Even though numerous features can help us tweak all file formats, no one has yet created an actual all-size-fits-all solution.

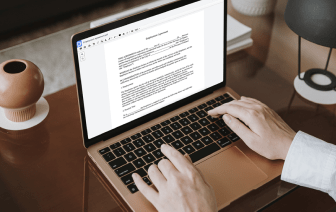

DocHub offers a simple and streamlined solution for editing, taking care of, and storing paperwork in the most popular formats. You don't have to be a tech-knowledgeable user to fill in FATCA in dot or make other modifications. DocHub is robust enough to make the process simple for everyone.

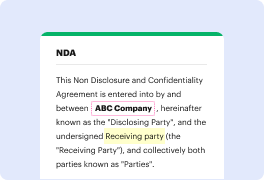

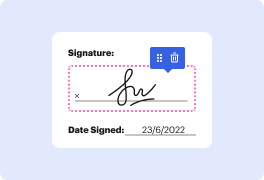

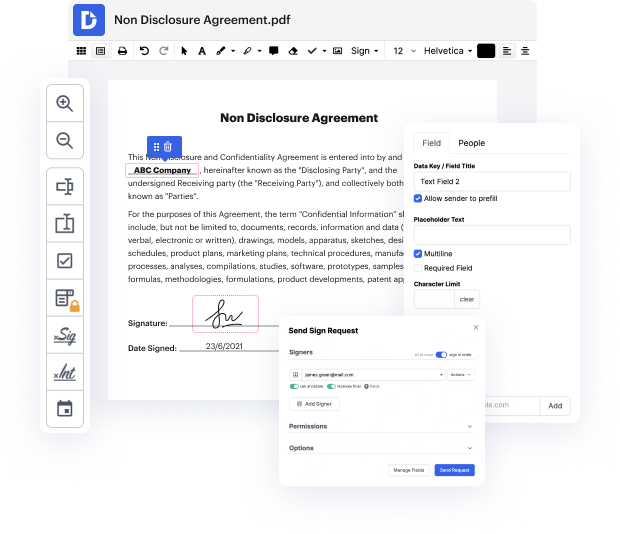

Our tool enables you to change and edit paperwork, send data back and forth, generate dynamic forms for data gathering, encrypt and safeguard documents, and set up eSignature workflows. Additionally, you can also generate templates from paperwork you utilize regularly.

You’ll find plenty of other functionality inside DocHub, such as integrations that let you link your dot file to different productivity programs.

DocHub is a simple, fairly priced option to manage paperwork and improve workflows. It provides a wide range of capabilities, from creation to editing, eSignature professional services, and web form developing. The application can export your documents in many formats while maintaining highest protection and following the greatest data protection criteria.

Give DocHub a go and see just how simple your editing transaction can be.

welcome to the peregrine quick guide to fatca and crs for what is fatca and crs these are tax initiatives vaca was introduced by the usa crs is an oecd initiative why have these initiatives their aim is to gather information from around the globe on individuals assets and pass that to the relevant jurisdiction of the individual the rationale for this is to assist with anti-money laundering and combating the financing of terrorism other information is obtained and provided during this process includes information on foreign accounts which may also include corporate entities and trusts certain accounts only reportable if they fall under certain criteria and information will often be based around the value and payments made to individuals this will affect shareholders settlers beneficiaries and protectors for more information please get in touch with the details on the screen thank you for listening