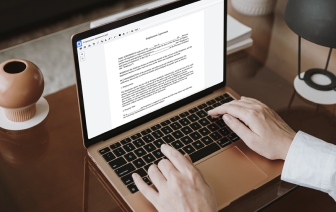

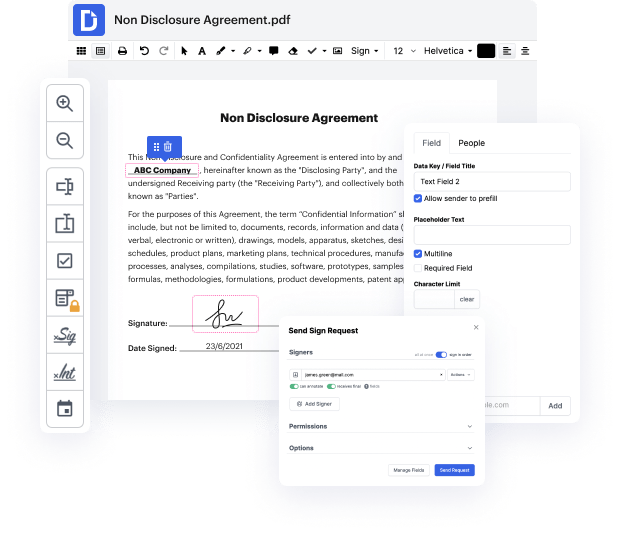

Of course, there’s no perfect software, but you can always get the one that perfectly brings together powerful functionality, straightforwardness, and reasonable price. When it comes to online document management, DocHub offers such a solution! Suppose you need to Faint sign in W-9 Tax Form and manage paperwork quickly and efficiently. In that case, this is the suitable editor for you - accomplish your document-related tasks anytime and from anywhere in only a few minutes.

Apart from rich functionality and simplicity, price is another great thing about DocHub. It has flexible and affordable subscription plans and enables you to test our service free of charge over a 30-day trial. Give it a try today!

hello my name is katie sanouris with cnrs wealth management and in this video were going to talk about how to fill out form w-9 lets get going [Music] first if you received a form w9 to fill out then use that paper form if you would like to go to the irs website google and search for w9 you will see irs.gov website and form w9 if you click on it you will be able to see form w9 which says request for taxpayer identification number and certification the poor is only one page long the rest of the pages are instructions it is fillable pdf you can fill it out and save it to your computer lets get to the four if you are sole proprietor small business owner independent contractor freelancer really often you will get a form w-9 from a company or in digital that youre doing the work for they use this form to collect your personal information and your ein number later they use that w9 form and information in it to fill out form 1099 which will be sent to you to the address you include in thi