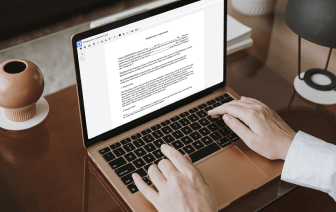

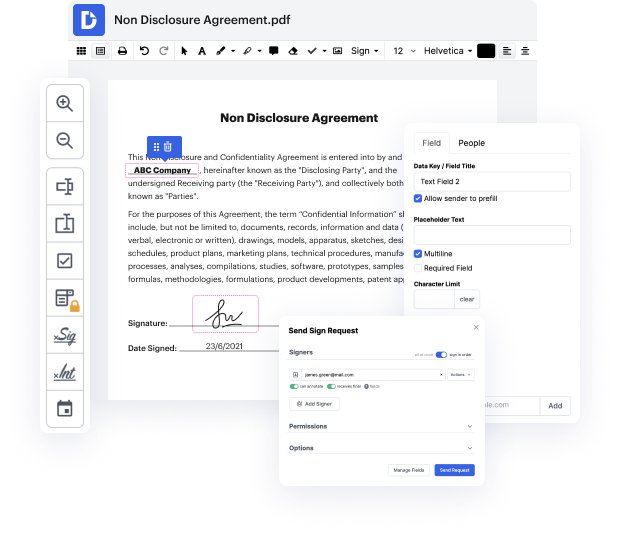

Editing HWP is fast and simple using DocHub. Skip installing software to your laptop or computer and make alterations with our drag and drop document editor in a few quick steps. DocHub is more than just a PDF editor. Users praise it for its ease of use and robust capabilities that you can use on desktop and mobile devices. You can annotate documents, generate fillable forms, use eSignatures, and send documents for completion to other people. All of this, combined with a competitive price, makes DocHub the perfect choice to faint FATCA in HWP files effortlessly.

Make your next tasks even easier by turning your documents into reusable web templates. Don't worry about the security of your data, as we securely keep them in the DocHub cloud.

the foreign account tax compliance act requires foreign Banks and financial institutions to report on financial accounts controlled by U.S connected persons to the IRS foreign financial institutions face severe penalties if they donamp;#39;t comply with fatca the information reported includes the name and ID on the account the account balance in the interest and dividends paid into the account the foreign account tax compliance act has caused some overseas Banks to stop accepting American clients because of the compliance costs involved with fatca