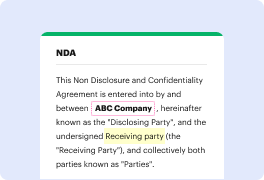

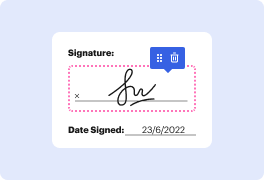

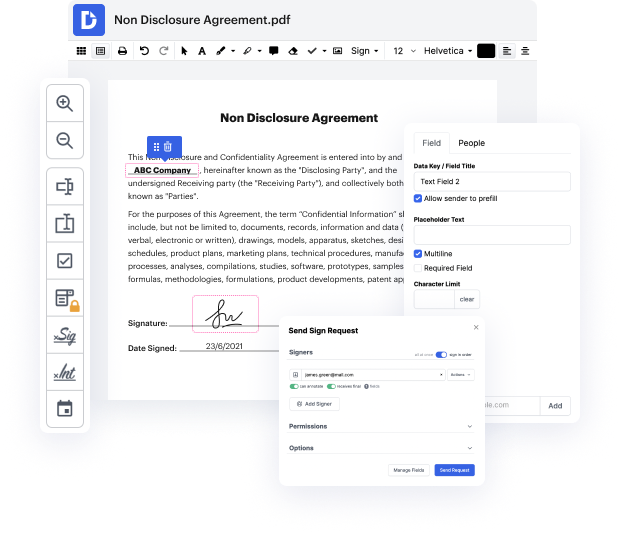

You no longer have to worry about how to faint expense in LOG. Our comprehensive solution guarantees easy and quick document management, allowing you to work on LOG files in a couple of minutes instead of hours or days. Our platform includes all the features you need: merging, inserting fillable fields, approving forms legally, placing signs, and so on. There’s no need to install additional software or bother with pricey applications demanding a powerful device. With only two clicks in your browser, you can access everything you need.

Start now and manage all different types of files professionally!

[Applause] hi Iamp;#39;m Lisa from GTA accounting professional corporation today we will discuss how to keep a mileage log to support your vehicle expenses in tax return do you often use your vehicle for business if you use your personal car to earn some form of business income you can claim the money youamp;#39;ve used as a business expense in your income tax filing youamp;#39;ll need a mileage log in order to claim this expense this log is simply a way of substantiating your claim we will share with your details below on how to keep a mileage log and the kind of motor vehicle expenses that you can claim how to keep a mileage log the CRA will require you to keep a mileage log for at least one year which is evidence for your car expense claims this logbook should have the follow information the date in which the vehicle is used for business the starting point and destination the purpose of the trip the cars starting and ending mileage the total miles covered for that trip you can ge