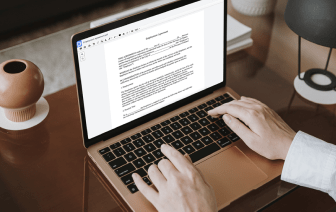

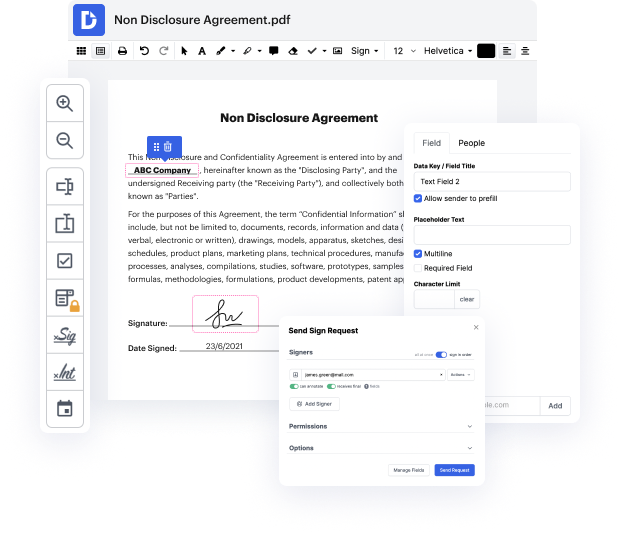

If you want to apply a small tweak to the document, it must not require much time to Excise title title. This kind of basic action does not have to require extra training or running through guides to learn it. With the proper document editing instrument, you will not take more time than is necessary for such a swift change. Use DocHub to streamline your editing process regardless if you are an experienced user or if it’s the first time making use of an online editor service. This tool will take minutes or so to learn how to Excise title title. The only thing needed to get more effective with editing is a DocHub profile.

A simple document editor like DocHub can help you optimize the amount of time you need to spend on document editing irrespective of your prior knowledge about this kind of resources. Make an account now and boost your efficiency instantly with DocHub!

is your company required to charge some kind of federal sales tax in addition to the normal state sales tax that you would have to charge your customers well then you should watch this video carefully how to record collect and pay federal sales tax if you have any questions about this topic you can leave them in the comments section below and ill do my best to help you and of course if you feel the video helped you i hope you will click like and dont forget to subscribe to get updates on new videos that come out all the time federal sales tax is an example of an out of scope sales tax this means that it is not on the preset list of sales tax agencies provided by quickbooks online it means you cannot use the sales tax center for this and you must record this type of sales tax the old-fashioned way that means that you have to set it up yourself and the on the list of products and services as a sales tax item and you also will have to do the calculation for h