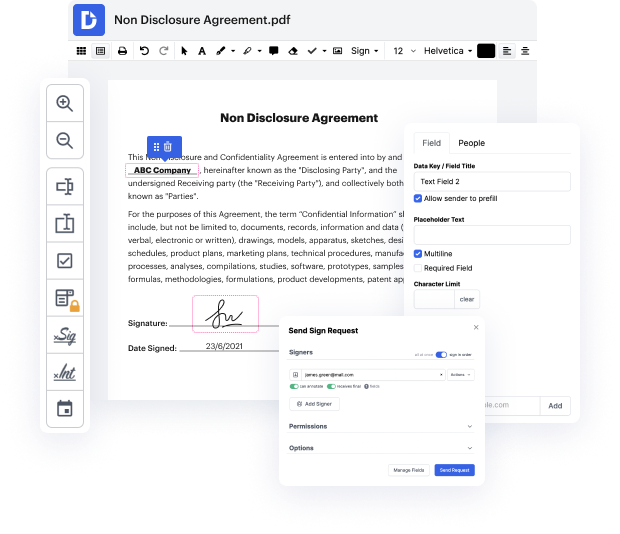

Are you looking for how to Excise Sum Permit For Free or make other edits to a document without downloading any software? Then, DocHub is what you’re after. It's easy, user-friendly, and safe to utilize. Even with DocHub’s free plan, you can benefit from its super handy tools for editing, annotating, signing, and sharing documents that let you always stay on top of your projects. Additionally, the solution offers seamless integrations with Google products, Dropbox, Box and OneDrive, and others, allowing for more streamlined transfer and export of documents.

Don’t spend hours looking for the right solution to Excise Sum Permit For Free. DocHub offers everything you need to make this process as simplified as possible. You don’t have to worry about the safety of your data; we adhere to standards in today’s modern world to protect your sensitive information from potential security risks. Sign up for a free account and see how straightforward it is to work on your paperwork productively. Try it now!

if you have someone in your household that has become physically disabled or is starting to become physically disabled and youre needing to make special arrangements for parking more and more you can apply through your state for a handicapped parking permit ill explain how we did it each state has its own website a government website and thats where youre going to go to get a permit application once you print that out youll need two important signatures on there youll know how to fill out the information for the person whos disabled its basically your name and address but the two signatures you need is one verification from the physician and two the verification from a notary that you are identified correctly with the the vehicle with the person who is going to be using the tag now you dont have to go to a notary necessarily to get it docHubd it would cost typically around five dollars to do that but you can also go to your state representatives office and they will have t

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more