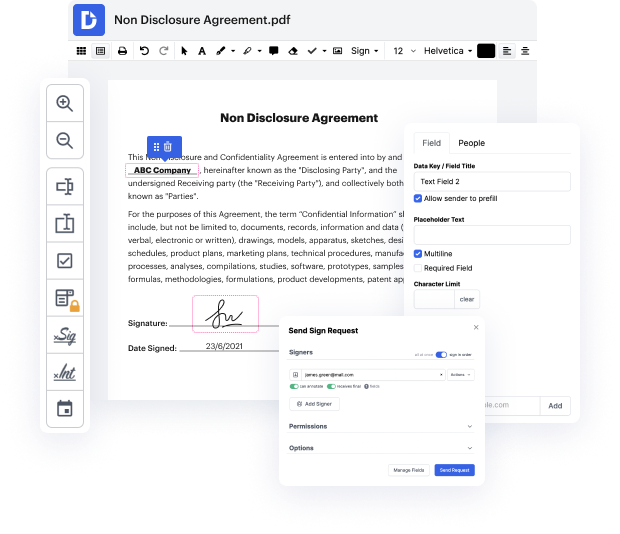

Are you looking for how to Excise Statistic Settlement For Free or make other edits to a file without downloading any application? Then, DocHub is what you’re after. It's easy, user-friendly, and secure to utilize. Even with DocHub’s free plan, you can benefit from its super useful tools for editing, annotating, signing, and sharing documents that let you always stay on top of your tasks. Additionally, the solution provides smooth integrations with Google products, Dropbox, Box and OneDrive, and others, allowing for more streamlined transfer and export of documents.

Don’t waste hours looking for the right tool to Excise Statistic Settlement For Free. DocHub provides everything you need to make this process as simplified as possible. You don’t have to worry about the security of your data; we adhere to standards in today’s modern world to shield your sensitive data from potential security threats. Sign up for a free account and see how effortless it is to work on your paperwork efficiently. Try it today!

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more