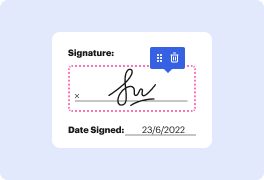

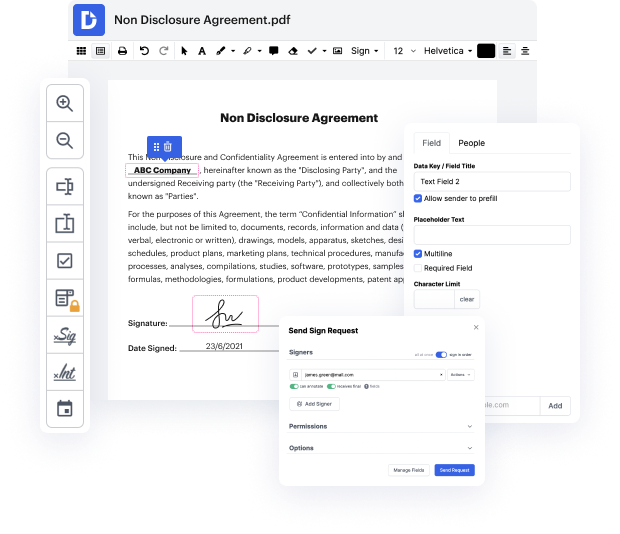

Are you searching for how to Excise Salary Log For Free or make other edits to a document without downloading any software? Then, DocHub is what you’re after. It's easy, intuitive, and safe to use. Even with DocHub’s free plan, you can take advantage of its super useful features for editing, annotating, signing, and sharing documents that let you always stay on top of your tasks. Additionally, the solution provides smooth integrations with Google products, Dropbox, Box and OneDrive, and others, allowing for more streamlined transfer and export of files.

Don’t waste hours searching for the right tool to Excise Salary Log For Free. DocHub provides everything you need to make this process as simplified as possible. You don’t have to worry about the safety of your data; we adhere to standards in today’s modern world to shield your sensitive data from potential security risks. Sign up for a free account and see how simple it is to work on your paperwork efficiently. Try it now!

This video tutorial explains how to handle federal sales tax in addition to state sales tax for your company. Federal sales tax is considered out of scope for Quickbooks Online, so you have to set it up manually as a sales tax item. You must record, collect, and pay federal sales tax separately from state sales tax. If you have any questions, leave them in the comments. Make sure to like the video if it helps and subscribe for more updates on similar topics.

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more