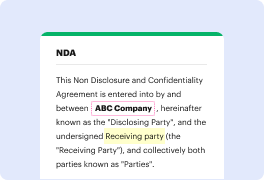

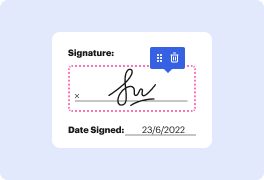

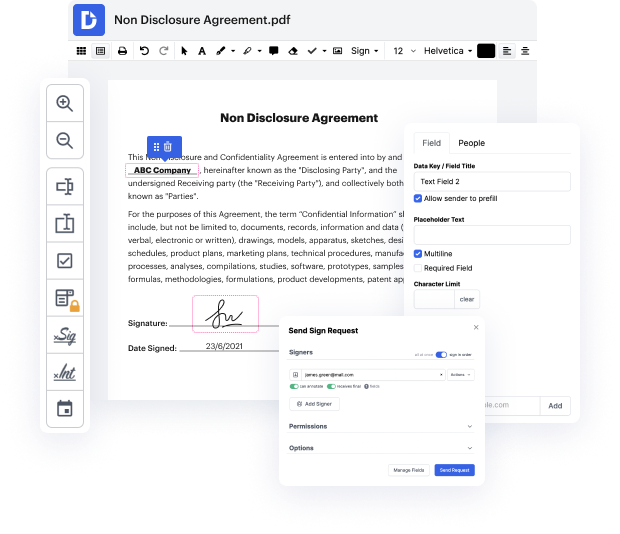

Are you looking for how to Excise Quantity Settlement For Free or make other edits to a file without downloading any application? Then, DocHub is what you’re after. It's easy, user-friendly, and secure to utilize. Even with DocHub’s free plan, you can take advantage of its super handy features for editing, annotating, signing, and sharing documents that let you always stay on top of your projects. Additionally, the solution offers seamless integrations with Google products, Dropbox, Box and OneDrive, and others, allowing for more streamlined import and export of documents.

Don’t waste hours looking for the right solution to Excise Quantity Settlement For Free. DocHub offers everything you need to make this process as simplified as possible. You don’t have to worry about the security of your data; we comply with regulations in today’s modern world to shield your sensitive data from potential security threats. Sign up for a free account and see how simple it is to work on your paperwork efficiently. Try it today!

Excise tax is a state tax on real property conveyance in North Carolina, paid by the seller. The formula is $1 per $500 of sale price. For a sale price of $200,000, excise tax would be $400.

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more