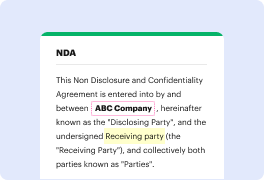

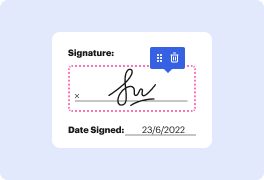

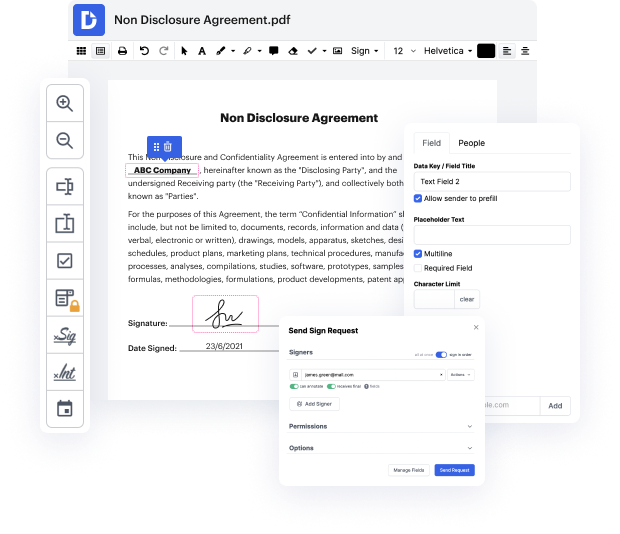

Are you looking for an editor that will allow you to make that last-minute tweak and Excise Nickname Work For Free? Then you're in the right place! With DocHub, you can swiftly apply any required changes to your document, no matter its file format. Your output files will look more professional and compelling-no need to download any software taking up a lot of space. You can use our editor at the comfort of your browser.

When using our editor, stay reassured that your sensitive information is protected and kept from prying eyes. We comply with significant data protection and eCommerce standards to ensure your experience is secure and enjoyable at every point of interaction with our editor! If you need help editing your document, our professional support team is always here to address all your queries. You can also take advantage of our comprehensive knowledge hub for self-assistance.

Try our editor now and Excise Nickname Work For Free effortlessly!

all right through the legs around the arms and shoulders okay stretch legs and arms now im ready to cheer [Music] gotta make sure my footwork is perfect footwork is how you win or lose a game go team [Music] ow what happened oh i see how it is she was trying to hog all the space so she hit me what an underhanded move also i dont feel very cheered up you dont stand a chance against cheer squad jake yeah thats totally what happened how dare she ill show her wait whats he doing to my pom-pom this is what you get for your backstabbing attack no way youre the one who crashed into me we cannot have this mess that is enough there is only one way to settle this a challenge has been issued fine ill show you jake ready good first up the soda uh are we just supposed to watch him drink i guess [Music] [Applause] you will need this much soda in your bottle put it on the ground and get ready kick it back into your hands that is the challenge what that was so cool yes i knew it was now its

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more