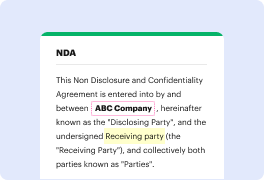

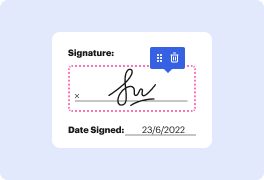

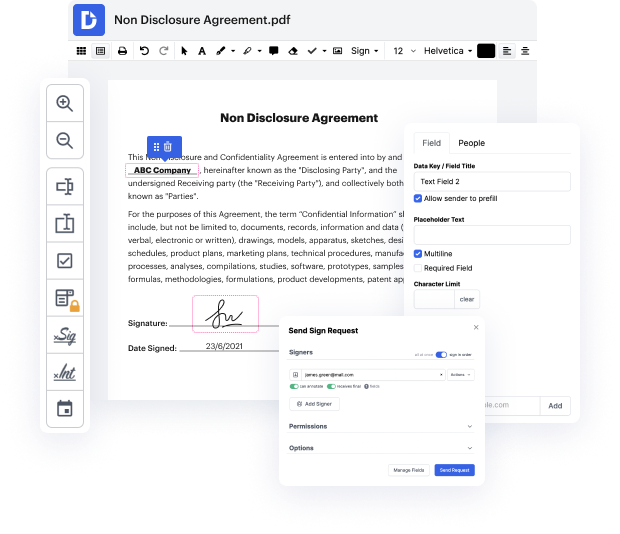

Contrary to popular belief, editing documents online can be trouble-free. Sure, some file formats might appear too challenging with which to work. But if you have the right solution, like DocHub, it's straightforward to edit any file with minimum resources. DocHub is your go-to solution for tasks as simple as the ability to Excise Nickname Settlement For Free a single document or something as daunting as handling a massive pile of complex paperwork.

When considering a solution for online file editing, there are many solutions out there. Yet, not all of them are powerful enough to accommodate the needs of people requiring minimum editing functionality or small businesses that look for more extensive set of tools that enable them to collaborate within their document-based workflow. DocHub is a multi-purpose solution that makes managing documents online more streamlined and easier. Try DocHub now!

"Settlement agreement exit package depends on the strength of evidence in negotiation with employer. Employer may not offer good deal unless they believe you were badly treated. Importance of providing evidence to support your case. Consider different perspectives within the company. Review your evidence to determine the strength of your case."

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more