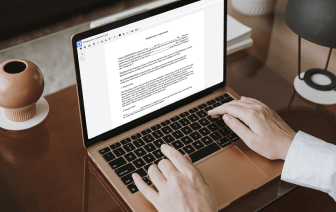

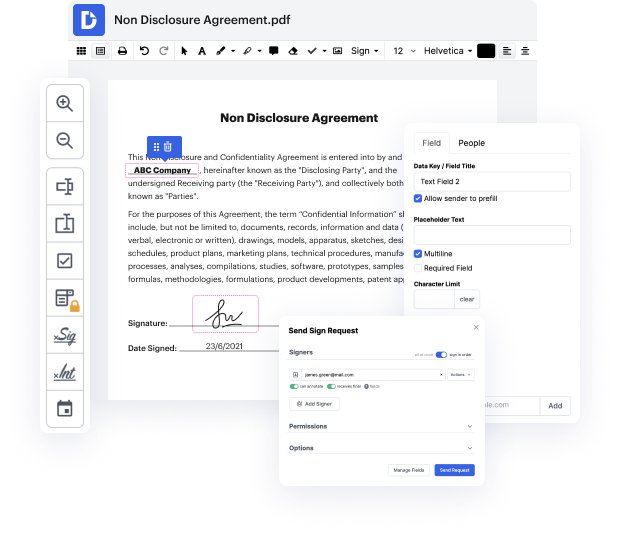

You know you are using the right document editor when such a simple job as Excise formula charter does not take more time than it should. Editing files is now an integral part of many working processes in different professional areas, which is the reason accessibility and simplicity are crucial for editing resources. If you find yourself studying guides or searching for tips about how to Excise formula charter, you may want to get a more user-friendly solution to save your time on theoretical learning. And this is where DocHub shines. No training is required. Simply open the editor, which will guide you through its main functions and features.

A workflow becomes smoother with DocHub. Take advantage of this tool to complete the paperwork you need in short time and get your productivity one stage further!

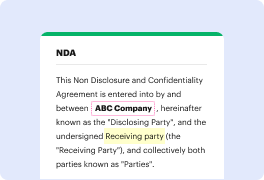

welcome to learn glass code now a series of short tutorials to help you get the best out of plus glass code software in this tutorial we will show how to calculate excise duty in plus glass code software this is the quotation made on a paper for customer ABC glass house where you enter all the details manually in this quotation we have 12 mm clear glass and 8 mm clear glass of different sizes with CP and coupling processes the total cost of glass item with processes is one leg 494 and 34 passe with additional cost like excise duty surcharge on excise duty educational says and wet the grand total is one left 27,000 30 rupees we will now make this code in plus blast code software the steps we are going to follow are add new project enter class sizes and processes head excise group on glass items change rates if required view and print quotation this is the dashboard of plus glass code click on new project to make a new code select customer ABC glass house next we select template excise