Working with documents can be a challenge. Each format has its peculiarities, which frequently results in complex workarounds or reliance on unknown software downloads to avoid them. Luckily, there’s a solution that will make this process less stressful and less risky.

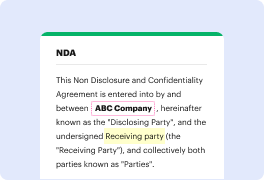

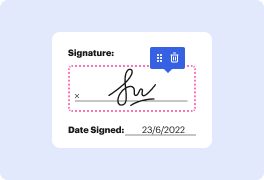

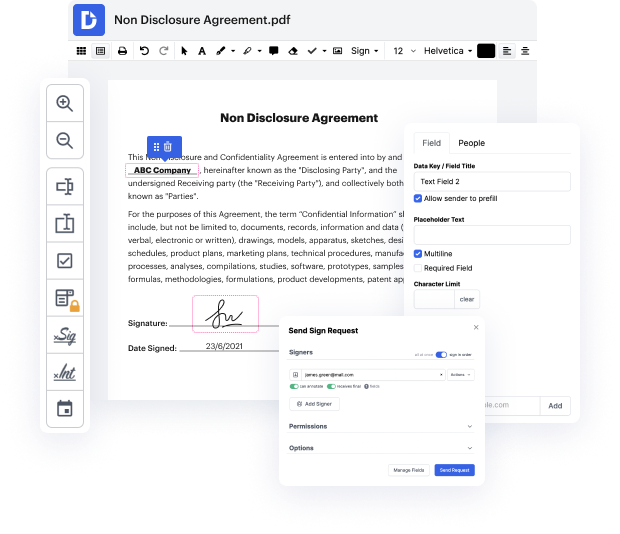

DocHub is a super straightforward yet full-featured document editing program. It has various tools that help you shave minutes off the editing process, and the option to Excise Contact Paper For Free is only a fraction of DocHub’s capabilities.

No matter if if you need occasional editing or to edit a huge document, our solution can help you Excise Contact Paper For Free and apply any other desired changes easily. Editing, annotating, signing and commenting and collaborating on documents is simple using DocHub. We support various file formats - choose the one that will make your editing even more frictionless. Try our editor free of charge today!

Caroline Jordan, a health coach, introduces a diabetes exercises level one video aiming to help viewers manage diabetes through a full-body workout to raise heart rate. It's important to consult a doctor before starting any exercise routine to prevent injury. Consistency in this exercise video can aid in treating and managing diabetes for a healthier and thriving life. Subscribe for more fitness content.

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more