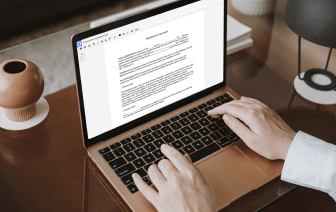

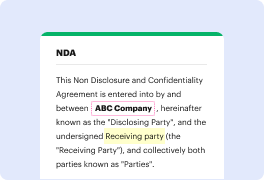

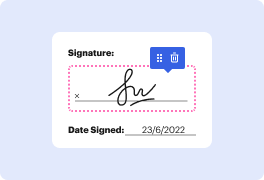

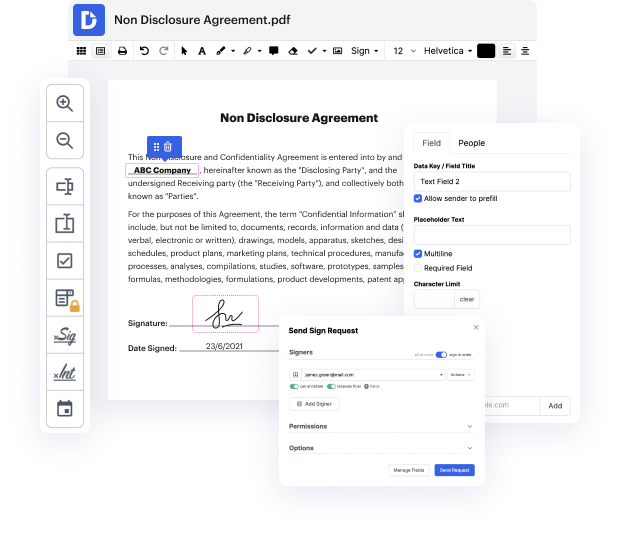

You realize you are using the right file editor when such a basic job as Excise comment invoice does not take more time than it should. Editing papers is now a part of a lot of working processes in various professional fields, which is why convenience and simplicity are essential for editing instruments. If you find yourself studying tutorials or looking for tips about how to Excise comment invoice, you might want to get a more easy-to-use solution to save your time on theoretical learning. And here is where DocHub shines. No training is required. Just open the editor, which will guide you through its principal functions and features.

A workflow gets smoother with DocHub. Make use of this instrument to complete the paperwork you need in short time and take your productivity to the next level!

I mean just to Echo some of my colleagues I do think that this is the wrong way to go about addressing gun violence I dont think anyone would say you know in certain areas of the country we shouldnt be addressing these issues but to tax someone for purchasing something legally that is a law-abiding citizen I dont think is the appropriate way to go I think theres other things the government could probably do to prevent some of these particularly as you said the pandemic you know getting kids back in school getting people back to work helping those who suffer from substance abuse issues and mental health issues as a result or were exacerbated as a result of the pandemic so I I do think theres other things that can be done that would be more productive than necessarily creating a new punitive tax on on those who are legal gun owners who are law-abiding citizens they are not the ones in my opinion who should be a target of this so thank you very much for your testimony