Working with documents can be a daunting task. Each format comes with its peculiarities, which often results in confusing workarounds or reliance on unknown software downloads to avoid them. Luckily, there’s a solution that will make this process more enjoyable and less risky.

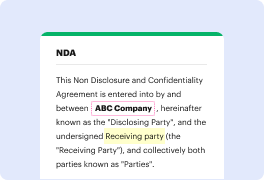

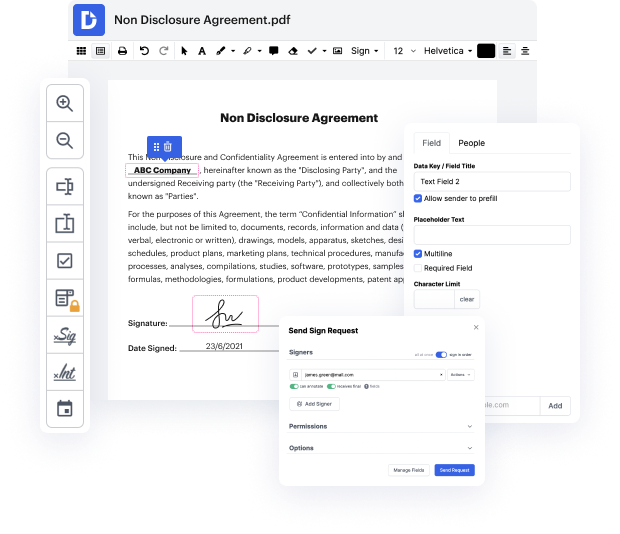

DocHub is a super simple yet full-featured document editing program. It has different features that help you shave minutes off the editing process, and the ability to Excise Amount Certificate For Free is only a small part of DocHub’s functionality.

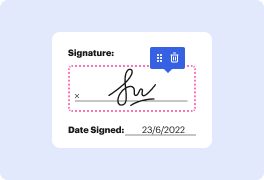

Whether if you need occasional editing or to edit a multi-page document, our solution can help you Excise Amount Certificate For Free and apply any other desired changes quickly. Editing, annotating, signing and commenting and collaborating on files is simple using DocHub. We support different file formats - choose the one that will make your editing even more frictionless. Try our editor free of charge today!

[Music] hello viewers you are watching research educational tips channel so you are on the road to knowledge today im gonna show you how to apply for financial aid on coursera to get a free certificate this is my account on coursera in my first video i have just shown you how you can enroll and learn courses online for free through coursera platform today ill focus on how you can apply for financial aid to get a certificate immediately after you completed the course that you have rolled for so here i will apply for the course that i want to learn for example i want to learn the course like management for example here are the results leading people and themes principles of management google project management many other options so let me take this course principles of management from john hopkins university here are all the information so i will apply for financial aid principles of management application can take up to 15 days to be reviewed meaning after you applied for financial a

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more