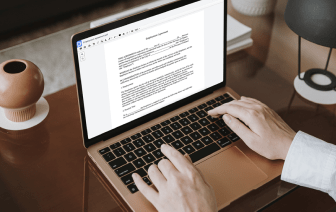

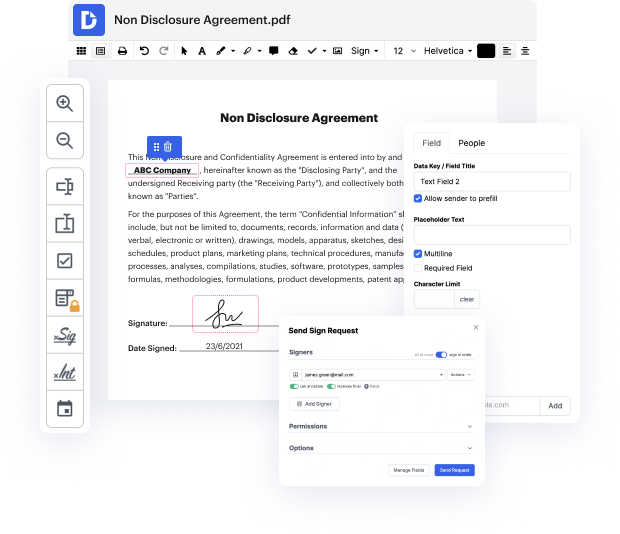

DocHub allows you to embed card in Forbearance Agreement Template quickly and conveniently. No matter if your document is PDF or any other format, you can effortlessly modify it using DocHub's intuitive interface and powerful editing features. With online editing, you can alter your Forbearance Agreement Template without downloading or installing any software.

DocHub's drag and drop editor makes customizing your Forbearance Agreement Template easy and efficient. We safely store all your edited papers in the cloud, enabling you to access them from anywhere, anytime. In addition, it's straightforward to share your papers with people who need to go over them or create an eSignature. And our native integrations with Google services enable you to transfer, export and modify and endorse papers directly from Google apps, all within a single, user-friendly platform. Additionally, you can effortlessly turn your edited Forbearance Agreement Template into a template for recurring use.

All processed papers are safely saved in your DocHub account, are easily managed and shifted to other folders.

DocHub simplifies the process of completing document workflows from the outset!

good afternoon Im here in my office on a Saturday and I just wanted to cut a short video this is for the Fair Credit Reporting Act a credit damage as part of my practice and theres some very important information that consumers need to know given right now that a lot of consumers are approaching banks and mortgage lenders and car lenders and theyre asking for or forbearance agreements and now what a forbearance is remember a forbearance is the bank or the lender is not forgiving your payments what theyre doing is theyre theyre saying in May June and July of 2020 you dont have to pay them but at the end of your you know at the end of your term for that particular loan theyll tack on three months that you have to pay then so really what theyre doing is theyre forgiving the loan at this moment but theyre taking that same those same two three four or five payments theyre attacking them on at the end okay now what happens in forbearance agreements a lot of times is that people e