When you deal with diverse document types like Retirement Plan, you know how important precision and attention to detail are. This document type has its own specific structure, so it is essential to save it with the formatting undamaged. For this reason, dealing with this sort of documents might be a struggle for traditional text editing applications: one wrong action might ruin the format and take extra time to bring it back to normal.

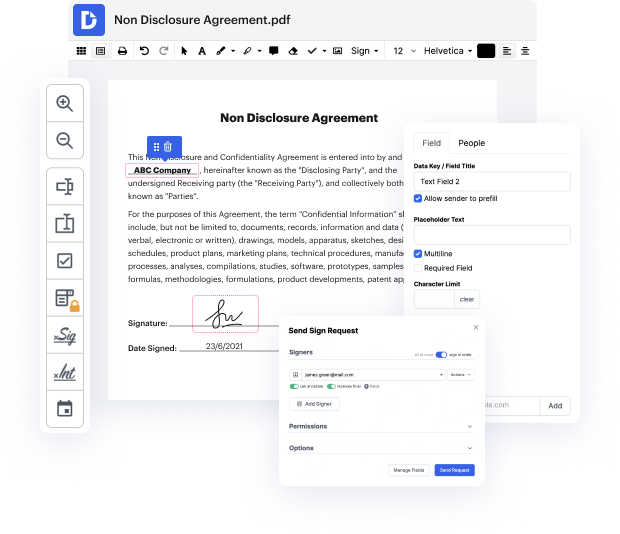

If you wish to edit picture in Retirement Plan with no confusion, DocHub is a perfect instrument for such tasks. Our online editing platform simplifies the process for any action you might need to do with Retirement Plan. The streamlined interface is suitable for any user, no matter if that individual is used to dealing with such software or has only opened it the very first time. Access all modifying instruments you require quickly and save time on day-to-day editing tasks. You just need a DocHub account.

Discover how effortless papers editing can be regardless of the document type on your hands. Access all essential modifying features and enjoy streamlining your work on documents. Sign up your free account now and see instant improvements in your editing experience.

Americans are worried about not saving enough for retirement due to rising food prices. Sharon Epperson discusses the importance of not outliving your money in retirement. A study by the TIAA Institute found that people struggle to plan for retirement and may need to support themselves for two decades after retiring. Individuals can contribute up to $22,000 in a 401(k) and $6,500 in an IRA, with key ages being 50 and 59 1/2 for additional contributions. Applying for Medicare at 65 is crucial to avoid penalties.