Dealing with papers implies making small modifications to them everyday. Occasionally, the job runs nearly automatically, especially if it is part of your day-to-day routine. However, in other cases, dealing with an unusual document like a 1099-MISC Form may take valuable working time just to carry out the research. To ensure that every operation with your papers is easy and swift, you need to find an optimal editing tool for this kind of jobs.

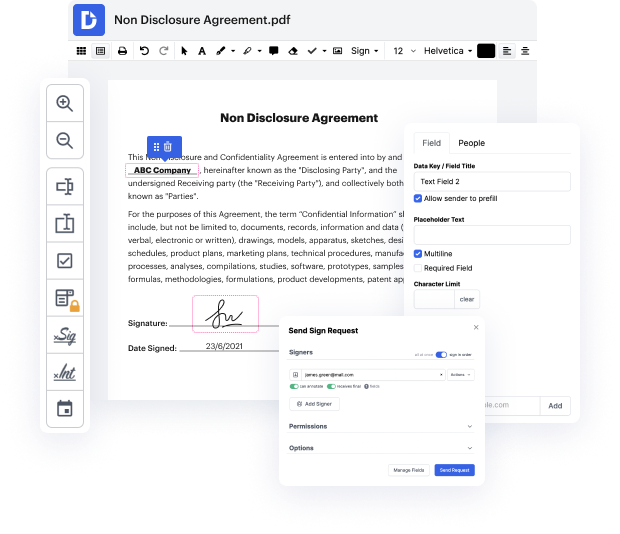

With DocHub, you are able to learn how it works without taking time to figure everything out. Your tools are organized before your eyes and are easy to access. This online tool does not need any sort of background - education or experience - from its users. It is all set for work even if you are not familiar with software traditionally used to produce 1099-MISC Form. Quickly make, edit, and share papers, whether you work with them daily or are opening a new document type the very first time. It takes moments to find a way to work with 1099-MISC Form.

With DocHub, there is no need to research different document types to figure out how to edit them. Have all the go-to tools for modifying papers at your fingertips to improve your document management.

This video tutorial by Kayla Weaver discusses form 1099 miscellaneous and the IRS filing requirements. It explains how the form w-9 is used in relation to form 1099 miscellaneous, and provides an example of the form. The video highlights why the form is required, especially for employees who receive a form w2 from their company showing total wages and withholdings. The IRS uses this information to match against tax returns to ensure all income is reported accurately. Self-employed individuals do not receive a form w2.

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more