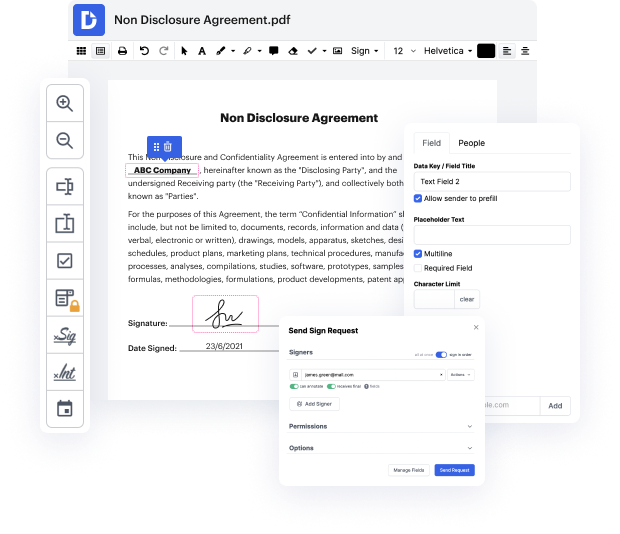

You know you are using the proper document editor when such a simple job as Draw company record does not take more time than it should. Modifying documents is now a part of numerous working processes in numerous professional areas, which is why convenience and efficiency are crucial for editing instruments. If you find yourself studying manuals or searching for tips about how to Draw company record, you may want to find a more user-friendly solution to save time on theoretical learning. And this is where DocHub shines. No training is needed. Just open the editor, which will guide you through its main functions and features.

A workflow gets smoother with DocHub. Use this tool to complete the documents you need in short time and take your productivity one stage further!

[Music] hi Emanuela Cordell and a communicates visually this means I communicate your topics with the health of visual language life your lecture for presentation or to illustrate your project visual language is ideal for arousing emotions creating connections and simplifying complex matters this applies to any positioning regardless of the size or sector of the company how can you imagine this in practical terms there are different approaches either you represent the big picture or you take the big picture and break it down into smaller parts to create clarity down to the last detail to structure processes and clarify contents and finally form a new big picture [Music] [Music] scientifically it has been proven that images are not only better understood but also remembered the Explorer workshops use this method to conceive creative paths break down barriers and solve problems this is how new ideas emerge in any case the result of visual communication is the elimination of misunderstan

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more