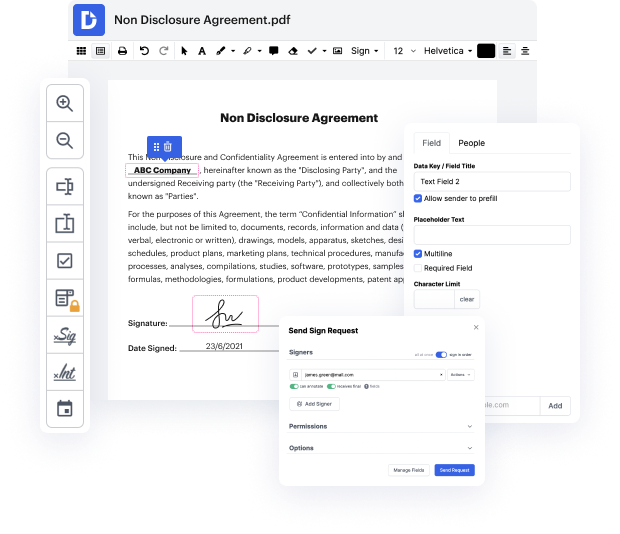

You know you are using the proper document editor when such a simple task as Deposit chart certificate does not take more time than it should. Editing papers is now an integral part of a lot of working operations in various professional fields, which is why convenience and efficiency are crucial for editing instruments. If you find yourself studying manuals or looking for tips about how to Deposit chart certificate, you might want to get a more intuitive solution to save your time on theoretical learning. And here is where DocHub shines. No training is needed. Simply open the editor, which will guide you through its principal functions and features.

A workflow becomes smoother with DocHub. Use this instrument to complete the files you need in short time and get your productivity to a higher level!

A certificate of deposit, or CD, is a deposit an investor makes to a bank or broker, earning the investor interest over a predetermined period of time. Many people invest in CDs because theyre a relatively safe, short-term investment that typically provides a higher interest rate than a savings or money market account. The main difference between savings or money market accounts and CDs is time. With a savings or money market account, an investor can withdraw funds at any point with no penalty. However, with a bank CD, an investor is required to keep the money deposited with the bank for the term of the CD, or pay an early withdrawal fee. CDs are available in different lengths, deposit amounts, and interest rates. Terms and fees can also vary. While individual CDs can vary drastically, the majority are issued either by a bank or a brokerage. Bank CDs are usually FDIC-insured for up to a certain amount, meaning theyre guaranteed by the U.S. federal government against loss. Brokered C

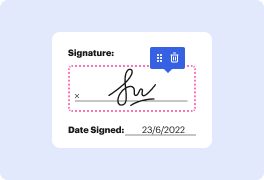

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more