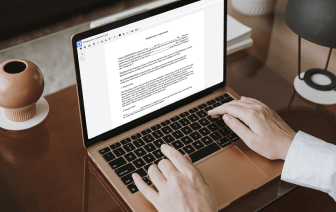

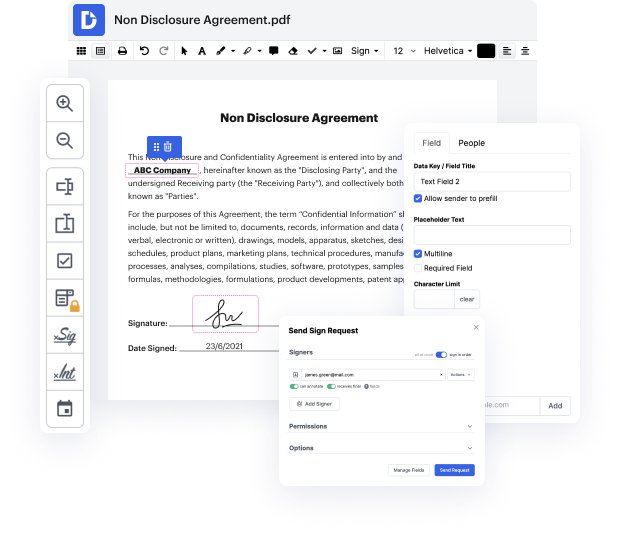

Are you searching for a simple way to delete symbol in 1040 Form? DocHub provides the best solution for streamlining form editing, signing and distribution and form endorsement. Using this all-in-one online platform, you don't need to download and install third-party software or use multi-level file conversions. Simply upload your form to DocHub and start editing it quickly.

DocHub's drag and drop user interface enables you to swiftly and effortlessly make modifications, from intuitive edits like adding text, photos, or visuals to rewriting entire form pieces. In addition, you can endorse, annotate, and redact papers in a few steps. The solution also enables you to store your 1040 Form for later use or transform it into an editable template.

DocHub offers more than just a PDF editing program. It’s an all-encompassing platform for digital form management. You can use it for all your papers and keep them secure and swiftly accessible within the cloud.

Did you miss a credit or deduction, or need to correct something else on your tax return for this year or past years? If so, you can file an amended tax return. Here are five things you need to know about amending a tax return: First, be sure to identify the year of the return youre amending. Remember, normally you can only go back three years. Second, choose how you want to file your amended return. Returns for tax year 2019 or later can be amended electronically. If youre amending a return prior to 2019, youll need to mail the paper Form 1040-X to the IRS. Third, if youre amending more than one return, you must prepare a separate 1040X for each year. If you mail these Forms 1040-X to the IRS, use separate envelopes, and be sure to send them to the correct IRS address depending on where you live. You can find this information in the forms instructions. Fourth, if youre filing for an additional refund, wait until you get your original refund before filing a 1040-X. F