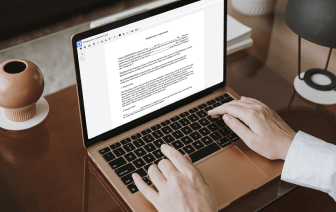

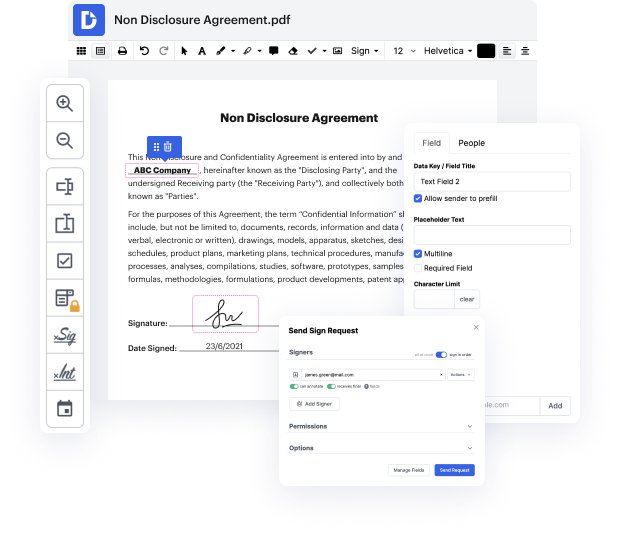

Time is a vital resource that each enterprise treasures and tries to transform in a gain. When selecting document management application, pay attention to a clutterless and user-friendly interface that empowers users. DocHub delivers cutting-edge tools to maximize your document management and transforms your PDF editing into a matter of one click. Delete Mandatory Field in the Assignment Of Mortgage with DocHub to save a ton of time as well as increase your efficiency.

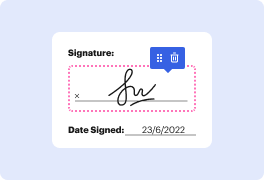

Make PDF editing an simple and intuitive process that saves you a lot of precious time. Quickly modify your documents and give them for signing without the need of turning to third-party software. Give attention to relevant tasks and increase your document management with DocHub right now.

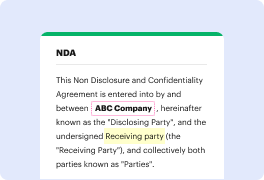

assignment of mortgage proceeds the assignment of mortgage proceeds directs that all mortgage funds advanced by your mortgage lender will be paid to the sellers lawyer this is an irrevocable direction and is required as part of the trust conditions used among lawyers to properly complete your closing