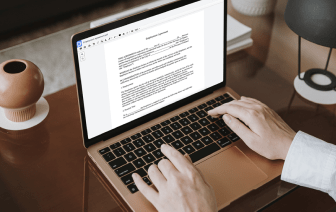

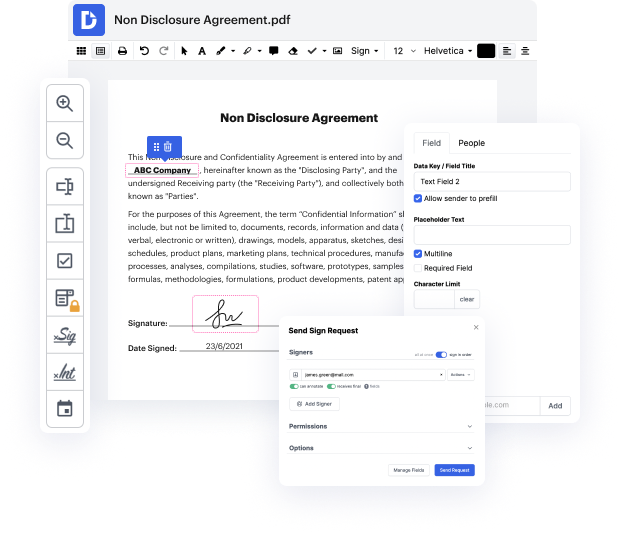

Time is a crucial resource that every business treasures and attempts to convert in a gain. In choosing document management software, be aware of a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge features to maximize your document management and transforms your PDF editing into a matter of a single click. Delete List into the Consumer Credit Application with DocHub to save a ton of efforts and boost your efficiency.

Make PDF editing an simple and intuitive operation that saves you plenty of precious time. Effortlessly change your files and give them for signing without the need of adopting third-party options. Focus on relevant tasks and increase your document management with DocHub starting today.

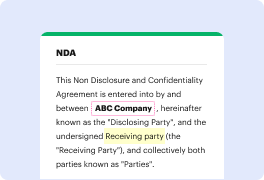

[Music] but what a lot of people fail now to comprehend is that FICO Advantage their only algorithms they have nothing to do with your credit they are a risk model that takes the information from your Consumer Report most of the stuff that you wrote nine times out of ten is what most people knew about credit yeah so if you can just touch on some of the things that you wrote in that book and then Im going to follow up now with the consumer with the consumer law portion of it and show now how theres this big separation between a FICO score or a vantage score versus whats really on the consumer yes a lot of people go to Credit Karma right and they see a score on Credit Karma and theyre like yo that is my score that is my score well not really it is a risk score yeah but its not what 90 of banks use 90 of banks use your FICO youre the FICO two FICO four five eight nine ten ten T based on the different model that that institution has hey wait wait wait wait wait I know you want to wat