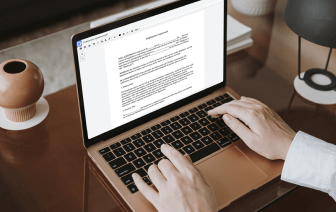

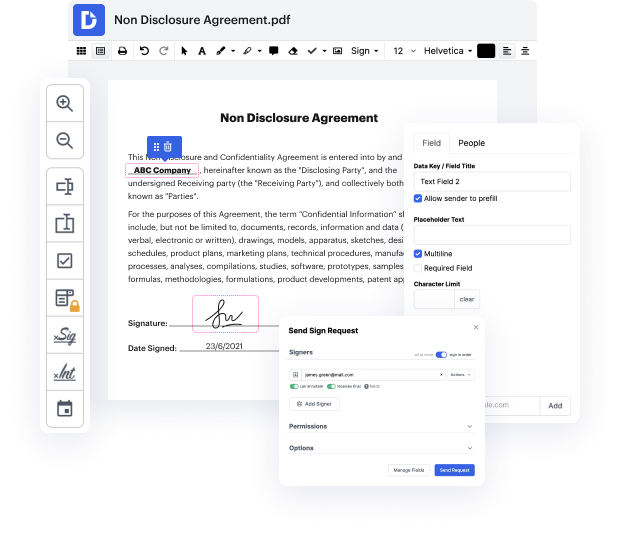

Time is a crucial resource that each company treasures and tries to turn into a advantage. In choosing document management application, take note of a clutterless and user-friendly interface that empowers consumers. DocHub provides cutting-edge instruments to improve your file management and transforms your PDF editing into a matter of one click. Delete Fileds into the Church Donation Giving Form with DocHub to save a lot of efforts and enhance your efficiency.

Make PDF editing an simple and intuitive operation that saves you a lot of precious time. Easily change your files and send out them for signing without the need of adopting third-party alternatives. Focus on pertinent tasks and improve your file management with DocHub starting today.

hello everyone and welcome to todays webinar my name is rachel klein and i will be your presenter here for the next 20 minutes uh today were going to be talking about a feature in donations for deleting old historical data specifically to the donations module so what this process allows you to do is go in and remove years of giving and pledging information by doing that its going to then free up those people for you to go in and then go back and delete them if you want to so this is a really helpful feature specifically for our customers who have been with us for 20 25 years this is going to allow you to go back to the years you have giving completely remove the data for those years and then in turn that will allow you to go back and delete people if you so wish so clean up your database a little bit okay and in the book theres a couple couple things that it goes over one thing i definitely recommend doing is making a backup of your data before you do this okay any time you see the