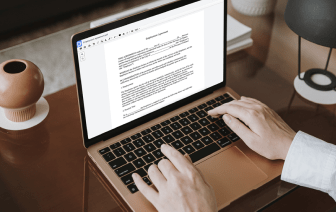

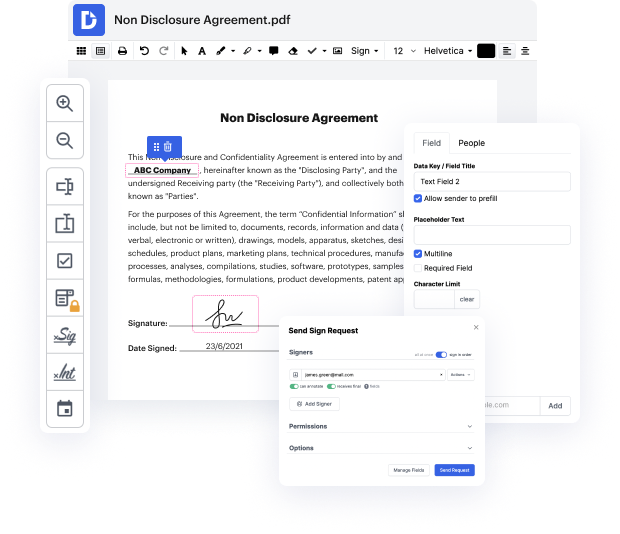

Time is a vital resource that every organization treasures and tries to turn in a gain. When choosing document management software program, take note of a clutterless and user-friendly interface that empowers consumers. DocHub delivers cutting-edge tools to enhance your file managing and transforms your PDF editing into a matter of one click. Delete Calculations from the Deferred Compensation Plan with DocHub in order to save a lot of efforts and boost your productiveness.

Make PDF editing an simple and easy intuitive operation that helps save you a lot of valuable time. Easily modify your documents and give them for signing without the need of adopting third-party options. Concentrate on relevant duties and increase your file managing with DocHub starting today.

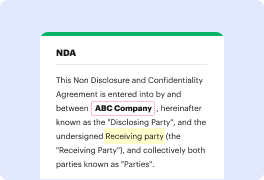

what is a 457b plan what are the advantages disadvantages and how do you invest in it to build a large amount of wealth a 457b is very similar to a 401k usually 401ks are offered in a private sector and a 457b is offered for government employees or not-for-profit employees whether it be a 401k or 457b 403b tsp ira they generally all do the exact same thing theyre there for you to invest in your retirement and get a ton of tax benefits for doing so first question is there an income requirement in order to be eligible to contribute to a 457b unlike a roth ira that has income limits there is no income limits for a 457b if your employer offers a 457b you are eligible to contribute to it as of 2021 the contribution limit is 19 500 that you can put into your own 457b or if youre age 50 and older you can do whats called catch-up contributions where you can contribute up to 26 000 into your 457. i dont want to confuse you but i will tell you this it does say in the irs code that you can co