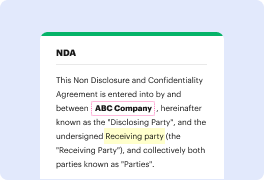

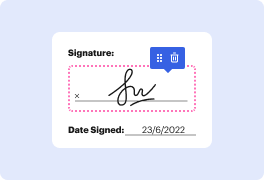

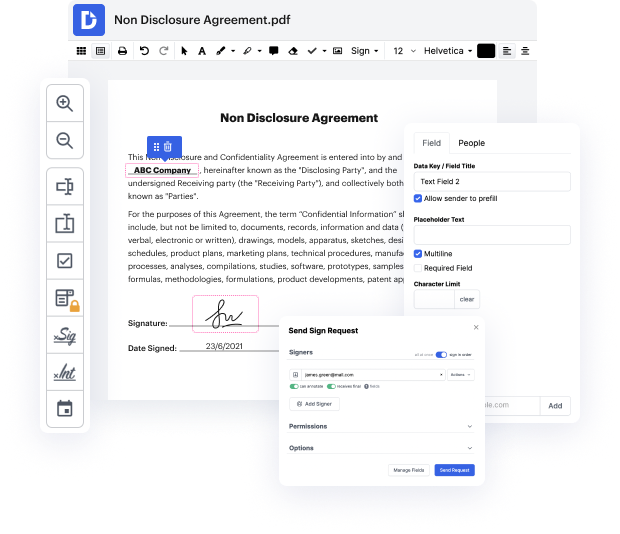

Document-based workflows can consume plenty of your time, no matter if you do them routinely or only sometimes. It doesn’t have to be. In fact, it’s so easy to inject your workflows with additional efficiency and structure if you engage the proper solution - DocHub. Advanced enough to tackle any document-related task, our software lets you adjust text, photos, comments, collaborate on documents with other users, create fillable forms from scratch or web templates, and digitally sign them. We even protect your information with industry-leading security and data protection certifications.

You can access DocHub editor from any place or device. Enjoy spending more time on creative and strategic work, and forget about monotonous editing. Give DocHub a try right now and watch your Profit Sharing Plan workflow transform!