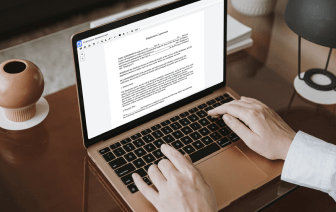

When you deal with different document types like Accounts Receivable Financing Agreement, you understand how important accuracy and focus on detail are. This document type has its own particular format, so it is crucial to save it with the formatting undamaged. For this reason, working with this kind of paperwork might be a struggle for conventional text editing software: a single incorrect action may ruin the format and take extra time to bring it back to normal.

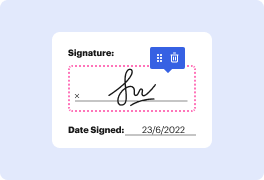

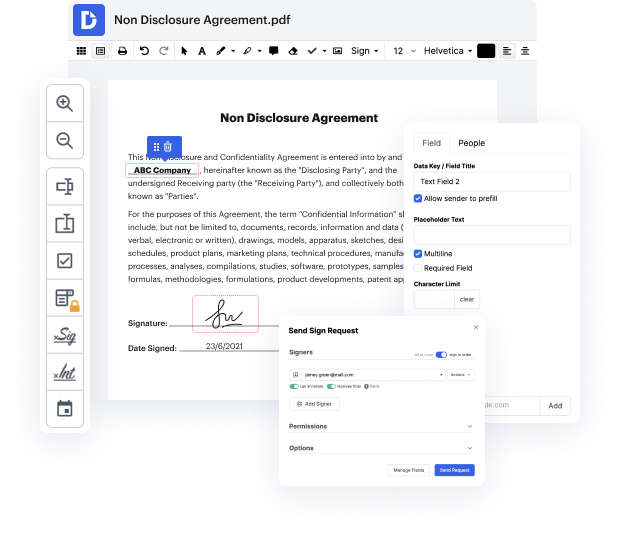

If you wish to copy writing in Accounts Receivable Financing Agreement without any confusion, DocHub is an ideal instrument for such tasks. Our online editing platform simplifies the process for any action you might need to do with Accounts Receivable Financing Agreement. The streamlined interface design is suitable for any user, no matter if that individual is used to working with such software or has only opened it for the first time. Access all modifying tools you require easily and save your time on day-to-day editing activities. You just need a DocHub account.

See how effortless document editing can be irrespective of the document type on your hands. Access all essential modifying features and enjoy streamlining your work on papers. Sign up your free account now and see instant improvements in your editing experience.

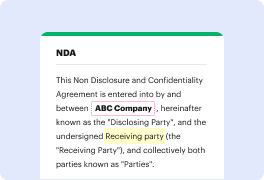

Accounts receivable based loans are a valuable financing option for startups with revenue or SAS-based businesses. Banks have always favored lending against accounts receivable due to their ability to assess customer credit quality, payment terms, and help businesses access cash quickly. By financing accounts receivable, businesses can receive funds upfront, albeit with a small fee, allowing them to improve cash flow and streamline operations.