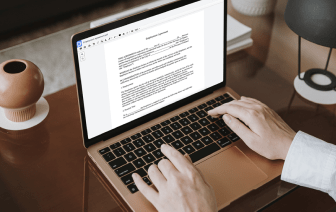

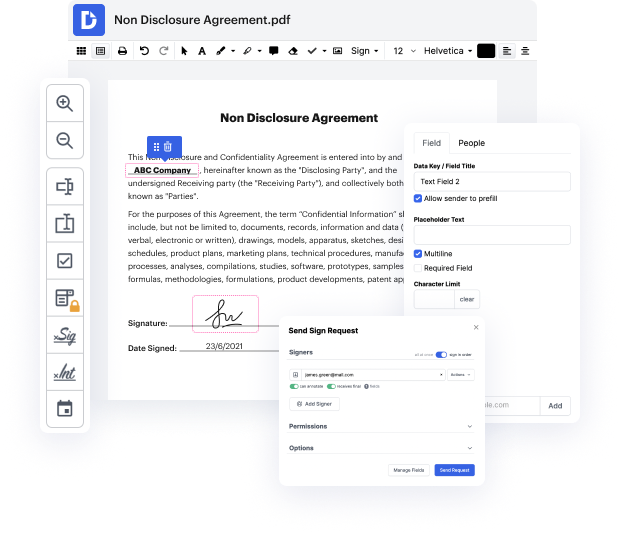

Are you searching for an easy way to copy number in 1040 Form? DocHub provides the best solution for streamlining form editing, certifying and distribution and form endorsement. With this all-in-one online program, you don't need to download and install third-party software or use multi-level document conversions. Simply import your form to DocHub and start editing it with swift ease.

DocHub's drag and drop user interface enables you to quickly and quickly make modifications, from simple edits like adding text, images, or graphics to rewriting whole form pieces. You can also endorse, annotate, and redact papers in a few steps. The solution also enables you to store your 1040 Form for later use or turn it into an editable template.

DocHub provides more than just a PDF editing system. It’s an all-encompassing program for digital form management. You can utilize it for all your papers and keep them secure and swiftly accessible within the cloud.

hey everyone im bradford with the penny finisher personal finance first make sure you hit that like button so you know to make more videos like it today im going to give you a walkthrough on how to fill out the irs form 1040 for tax year 2021 with a specific example of you who are single and with no dependents really the only situation where i would recommend you consider filling out the 1040 yourself you have a w-2 job say you work at mcdonalds or something like that where youre getting paid and youre not being paid as a contractor with 10.99 as your tax situation gets more complicated you start having investments say you start your own business things are going to get outside of the scope for the majority of people and using some sort of tax prep software or hiring out with a tax preparation company or a cpa is going to be your best option make sure you get your taxes done correctly so with that said lets actually jump into the forms and start going through how you would fill i